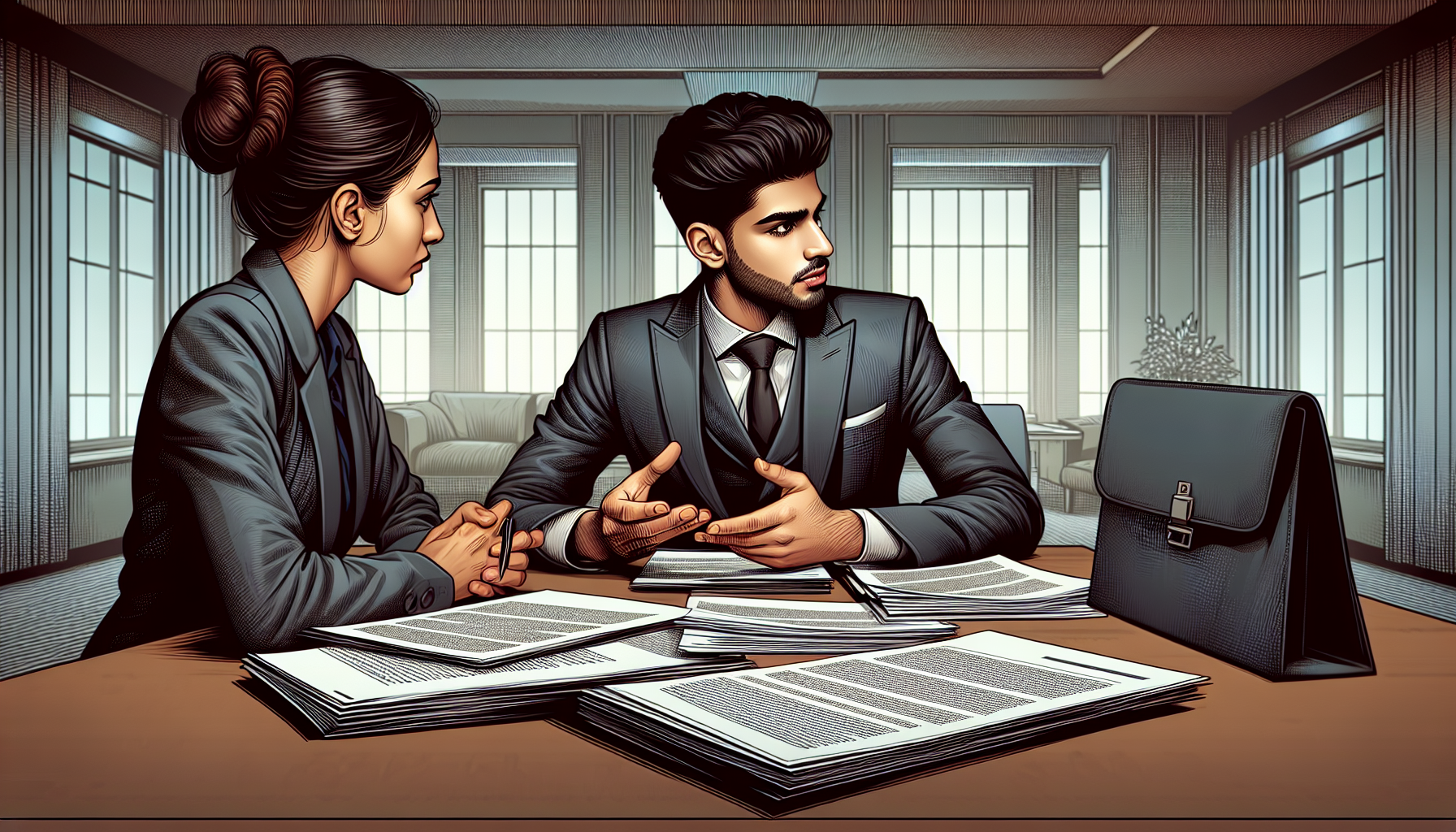

The terms mergers and acquisitions are often used interchangeably but there are major differences between the two.

Mergers are a business transaction that occur when two business entities consolidate into one. Mergers will generally end amicably with the reduction of power between two companies in an effort to create a more profitable and successful business under one legal entity.

An acquisition is when one company purchases and takes over ownership of another company—often referred to as a takeover—meaning one company will end all operations and not exist after an acquisition. A company may seek to acquire another company in order to corner the market, expand product offerings, grow internal technology services, obtain intellectual property, reduce production costs, optimize tax strategies, as well as a number of other reasons.

Often the terms “acquisition” or “takeover” have a negative connotation and thus businesses have started to refer to acquisitions as “mergers” even if the term is not technically true. Also, recently, there has been the emergence of the term “mergers and acquisitions,” or “M&A” has become a term more commonly used as a general consolidation or combining of companies through a financial transaction whether that be through an acquisition, merger, tender offers, etc.