Imagine the power of controlling multiple businesses while protecting your assets and enjoying tax benefits. This scenario is not a distant dream; it’s a reality for those who venture into the world of holding companies. By understanding the ins and outs of a holding company structure, you can tap into a realm of endless possibilities and long-term growth for your business endeavors.

Key Takeaways

- Holding company structure provides asset and operational stability for businesses of all sizes.

- Parent company oversees the operations, management, and strategic direction while providing financial security to subsidiaries.

- Benefits include liability protection, tax efficiency & flexibility. Potential challenges involve legal intricacies & establishment costs.

Deciphering the Holding Company Structure

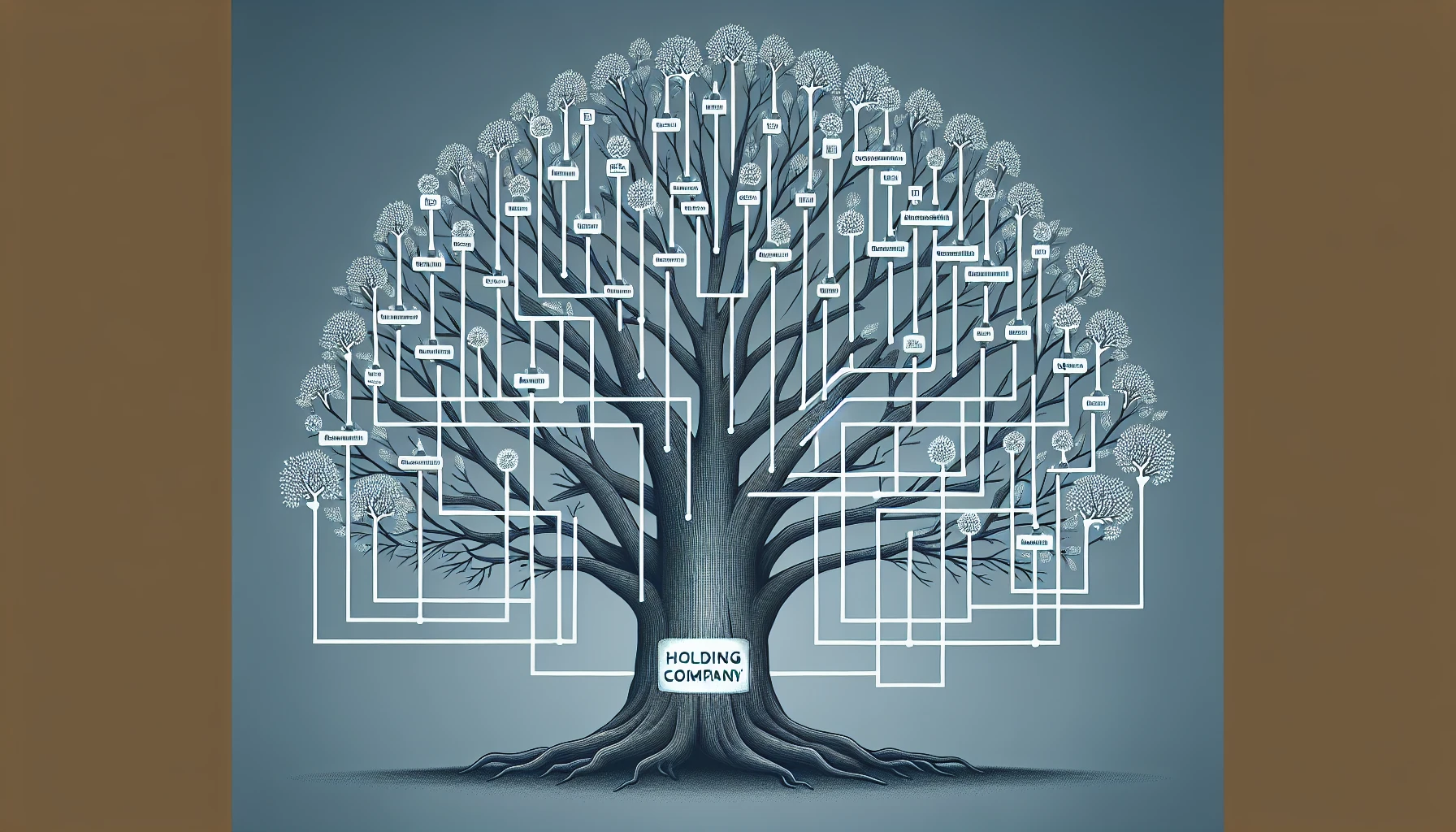

A holding company is a business entity that exists to own other companies and assets, including controlling interests but does not engage in their day-to-day operations. This unique structure allows the holding company to safeguard valuable assets such as real estate, intellectual property, and cash. Holding companies act as a shield in the active business world, providing a barrier between a firm’s daily operations and its significant assets, guaranteeing stability and security.

Holding companies come in various forms, such as personal holding companies, immediate holding companies, or conglomerates, each with its own advantages and challenges. All businesses, regardless of size, from expansive corporations to individual entrepreneurs, can reap the advantages of a holding company structure. For example, a large corporation that manufactures and sells a variety of consumer goods can potentially benefit from a holding company structure.

The Anatomy of a Holding Company

Amid the intricate network of the business world, holding companies carve out a stable base, enabling subsidiary companies to prosper. As the parent company or holding company maintains a majority stake in all associated businesses, it establishes a structure for control and oversight. While holding companies typically do not engage in day-to-day business operations, parent companies often function as large corporations with their own business units, and they also possess several subsidiaries.

The holding company structure facilitates:

- The segregation of significant assets from routine business operations

- Allowing the parent company and its subsidiaries to prosper without jeopardizing asset protection and financial stability

- The power to procure funds for investments through various means, such as obtaining equity interests, borrowing, and obtaining revenue from payments received from subsidiaries.

Parent Company at the Helm

Within a holding company structure, the parent company’s role is to:

- Exert authority and supervise its subsidiaries

- Own and manage its subsidiaries to effectively steer their operations, management, and strategic direction

- Ensure that subsidiaries operate independently

- Provide support to subsidiaries by utilizing its resources to reduce the cost of capital expenditure

- Provide a downstream guarantee for loans taken out by the subsidiary

The legal relationship between a parent company and its subsidiaries is crucial for the success of a holding company structure. By owning the voting shares of the subsidiary, the parent company maintains control over the subsidiary while allowing each entity to function as separate legal entities, responsible for their respective activities. This legal separation is essential for asset protection and efficient decision-making within the holding company structure.

Subsidiaries and Their Operations

Subsidiaries form the bedrock of a holding company structure. As distinct legal entities owned by the holding company, subsidiaries function autonomously, allowing them to focus on their specific business activities. For example, in a holding company structure within real estate, each rental property can be owned by a separate wholly owned subsidiary, which are all under the umbrella of the holding company.

The holding company’s ability to own businesses in unrelated industries has a significant advantage: it does not necessitate day-to-day management. As a result, the holding company can focus on its core function of maintaining ownership and control over its subsidiaries while allowing them to operate independently and efficiently.

The Interplay Between Entities

The rapport between parent companies and subsidiaries within a holding company structure delicately balances control and independence. By maintaining separate legal entities, parent companies can protect themselves from liability and safeguard their assets while ensuring that each subsidiary operates autonomously and efficiently. However, this separation also carries the risk of “piercing the corporate veil,” where a court may hold the parent company accountable for the subsidiary’s actions or debts if the subsidiary lacks autonomy from its parent.

To avoid this legal pitfall, it is crucial for holding companies and their subsidiaries to:

- Maintain separate financial records, assets, liabilities, and properties

- Ensure that each entity remains distinct

- Avoid intermingling business income and resources

By following these practices, holding companies can strike a balance between control and independence, allowing for efficient decision-making and asset protection while maintaining a controlling interest.

The Spectrum of Holding Company Types

The universe of holding companies is diverse, accommodating different business needs and strategies through various types of holding companies. For instance, a pure holding company solely holds controlling stock or membership interests in other companies, focusing exclusively on ownership and control, without engaging in its own business operations. In contrast, a mixed holding company, in addition to owning and controlling subsidiaries, also engages in its own business operations.

Other types of holding companies include immediate holding company and intermediate holding companies. These companies are typically owned by other holding companies or larger businesses. This variety of holding company structures allows businesses to choose the type that best aligns with their objectives and requirements, providing a tailored approach to asset protection, tax efficiency, and operational flexibility.

Strategic Advantages of a Holding Company

The holding company structure presents multiple strategic benefits, encompassing asset management and protection, tax efficiency, and operational adaptability. The ability to centralize control, diversify assets, and mitigate risk makes holding companies an attractive option for businesses seeking long-term growth and stability.

Moreover, holding companies can present several financial advantages, such as:

- Liability protection

- Tax benefits

- Efficient utilization of resources

- Asset protection

- Diversification and portfolio management

These advantages make holding companies an appealing choice for businesses aiming to maximize their profits and minimize their risks.

Asset Management and Protection

The protection of assets is a primary objective of a holding company. By establishing a holding company structure, businesses can create a protective layer around their valuable assets, ensuring they are shielded from potential liabilities. This separation of assets from daily business operations not only safeguards the parent company’s financial stability but also allows for efficient decision-making and autonomy within each subsidiary.

In addition, a holding company can help mitigate risk by keeping assets in a distinct entity, shielding them from the liabilities of other subsidiaries. This risk mitigation strategy is crucial for businesses seeking to protect their investments and ensure long-term growth.

Tax Efficiency and Financial Benefits

Holding companies can offer significant tax efficiency and financial benefits. Some advantages of holding companies include:

- Offsetting losses of one subsidiary against the profits of another subsidiary, reducing overall tax burden

- Allowing tax-free transfer of assets between subsidiary companies

- Taking advantage of varying taxation regimes by relocating operations to jurisdictions with more favorable business taxes while maintaining operations in the original location.

These tax benefits, combined with the potential savings and increased access to capital provided by holding companies, make them an enticing option for businesses looking to optimize their financial performance.

Operational Flexibility

Operational flexibility is a key advantage of holding companies, allowing them to swiftly adjust to evolving market conditions, incorporate novel technologies, and cultivate a culture of collaboration and receptiveness to ideas. This flexibility enables holding companies to confront disruptions, take advantage of new opportunities, and strive for continuous growth.

The operational flexibility of holding companies provides several advantages, including:

- Investment diversity, allowing businesses to invest in various industries and foster innovation

- The ability to pivot into new industries, broadening reach and profitability

- Ensuring long-term success

Potential Challenges of a Holding Company

Despite the manifold advantages, holding companies are also accompanied by possible challenges, including management hurdles, legal intricacies, and establishment costs. The holding company’s management may not always be proficient in the operating companies’ businesses, which can lead to discrepancies and conflicts of interest between the holding company and minority owners.

Additionally, holding companies must navigate various legal complexities, such as compliance with corporate governance, tax considerations, regulatory requirements, liability management, and intellectual property management. Holding companies must also consider the costs associated with forming and maintaining the holding company and its subsidiaries, including formation fees, annual reports, franchise tax obligations, and compliance with governing documents.

Steps to Establishing Your Own Holding Company

If you’re contemplating establishing your own holding company, adhering to a structured procedure promises a smooth transition. The first step involves selecting the appropriate business entity, such as a corporation or limited liability company, based on factors such as management, financial interests, and taxation. Once you’ve chosen your business structure, you’ll need to establish ownership and comply with the legal requirements for establishing a holding company in your chosen jurisdiction.

By carefully considering the type of business entity and adhering to the legal requirements of your chosen jurisdiction, you can set your holding company up for long-term success, benefiting from the advantages of business assets protection, tax efficiency, and operational flexibility.

Entity Selection and Formation

When determining the type of business entity for a holding company, factors such as management, financial interests, and taxation should be taken into consideration. Corporations and limited liability companies are the two most frequently employed entities for a holding company, with Delaware LLCs being the most popular option.

The procedure for establishing a Delaware LLC for an llc holding company consists of two essential steps: selecting your business structure and establishing ownership. By choosing the right business entity and forming it in accordance with state regulations, you can ensure the success and stability of your holding company.

Legal Considerations and Compliance

Compliance with state laws and regulations is imperative for holding companies. Each state may have its own regulations and requirements for holding companies to comply with, such as the appointment of a registered agent. A registered agent is an individual or business entity appointed by a corporation, LLC, or other business entity to accept service of process and official communications, ensuring that your holding company receives essential legal documents and communications.

Furthermore, holding companies must navigate various legal complexities, such as:

- Compliance with corporate governance

- Tax considerations, including tax liability

- Regulatory requirements

- Liability management

- Intellectual property management

By understanding and adhering to the compliance requirements of each state in which your holding company operates, you can mitigate potential legal risks and ensure the long-term success of your holding company.

Financial Setup and Record Keeping

Appropriate financial setup and meticulous record keeping are key to the success of a holding company. Establishing separate accounts in the business’s name for each entity ensures that personal and business finances are kept separate while allowing for the precise identification and monitoring of the financial operations, assets, liabilities, and performance of each subsidiary or operating company within the holding company.

Moreover, it is crucial for holding companies and their subsidiaries to:

- Maintain separate financial records

- Ensure openness, responsibility, and precise documentation for each entity

- Provide vital information for financial evaluation, decision-making, risk management, and adherence to regulations.

Real-World Examples of Successful Holding Companies

The triumphant narratives of famed holding companies such as Berkshire Hathaway and Alphabet demonstrate the potential merits and applications of this business model.

Berkshire Hathaway, under the guidance of Warren Buffett, has flourished through its:

- long-term investment strategy

- focus on acquiring high-quality companies

- diversified portfolio

- consistent returns

Similarly, Alphabet, the parent company of Google, has diversified its portfolio by investing in various subsidiaries involved in areas such as technology, life sciences, and artificial intelligence. These real-world examples demonstrate the power of holding companies in fostering growth, protecting assets, and achieving long-term success.

Summary

In conclusion, holding companies offer a strategic approach to managing multiple businesses while protecting assets, enjoying tax benefits, and maintaining operational flexibility. By understanding the various types of holding companies, their unique advantages and challenges, and the steps to establishing your own holding company, you can unlock the potential for long-term growth and stability in your business endeavors.

Armed with this knowledge, you can confidently navigate the world of holding companies and leverage their advantages to build a successful, resilient, and diversified business empire.

Helpful Resources

- Iternal Revenue Service (IRS) – Tax Information for Holding Companies

- URL: https://www.irs.gov/businesses/small-businesses-self-employed/holding-companies

- Description: The IRS provides detailed tax information relevant to holding companies, including filing requirements and specific tax implications.

- U.S. Securities and Exchange Commission (SEC) – Reporting Requirements for Holding Companies

- URL: https://www.sec.gov/fast-answers/answersholdcohtm.html

- Description: Essential for publicly traded holding companies, this SEC resource outlines reporting and compliance requirements.

- Small Business Administration (SBA) – Guide to Choosing Business Structures

- URL: https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

- Description: The SBA’s guide provides foundational insights into various business structures, including holding companies, helping in informed decision-making.

- Investopedia – Comprehensive Overview of Holding Companies

- URL: https://www.investopedia.com/terms/h/holdingcompany.asp

- Description: This article offers a detailed breakdown of the structure, types, and functions of holding companies, suitable for both beginners and experienced professionals.

- Harvard Business Review – Corporate Structure and Strategy Articles

- URL: https://hbr.org/topic/corporate-structure

- Description: HBR provides insightful articles focusing on corporate structure and strategic management, crucial for holding company operations.

- Entrepreneur Magazine – Business Structure Insights and Strategies

- URL: https://www.entrepreneur.com/topic/business-structure

- Description: Offers insights on the strategic use and management of holding companies among other business structures.

- Forbes – Strategic Insights on Holding Company Structures

- URL: https://www.forbes.com/sites/allbusiness/2020/02/15/business-holding-company/

- Description: Forbes provides a focused perspective on the strategic advantages and challenges of holding company structures.

- Bloomberg Business – Market Trends and Analysis for Holding Companies

- URL: https://www.bloomberg.com/search?query=holding%20companies

- Description: Bloomberg offers valuable market analysis and news relevant to holding company strategies and market decisions.

Frequently Asked Questions

What is the primary objective of a holding company?

The primary objective of a holding company is to protect and maintain the assets of a business.

What is the difference between a parent company and a holding company?

A parent company is involved in business operations, whereas a holding company is simply the owner of subsidiaries and does not engage in business itself.

What is a pure holding company?

A pure holding company is a corporate entity that holds controlling stock or membership interests in other companies, without engaging in any other activities.

What are the potential challenges of holding companies?

Holding companies can experience management difficulties, legal complexities, and formation costs, all of which can present significant challenges.

What are the steps to establishing a holding company?

The steps to establishing a holding company involve selecting the appropriate business entity, following legal requirements and compliance, and setting up financial records and record keeping.