Recent Insights into the Digital Asset Sector

While trading markets have shown diminished fervor in recent years, the momentum behind technological progress in the cryptocurrency arena hasn’t waned. Key developments span from layer 2 scaling solutions for Ethereum and Bitcoin blockchains to enhancements in cryptocurrency mining tools, innovative uses for non-fungible tokens (NFTs), advancements in decentralized finance (DeFi) models, and the rise of decentralized autonomous organizations (DAOs).

Recall our earlier conversation about the synergy between open-source innovation—fundamental to the crypto world—and the blockchain infrastructure that facilitates it. Companies spearheading these advances should evaluate safeguarding their intellectual property rights. This could encompass patenting inventions that either augment or run parallel to open, decentralized public ledgers, such as Bitcoin and Ethereum.

Patent Trends in Blockchain and Cryptoassets

The charts provided below highlight a trend: for consecutive years, there’s been a surge in patent applications linked to cryptoassets and other blockchain-centric innovations. However, a decline in this activity is notable in the most recent periods.

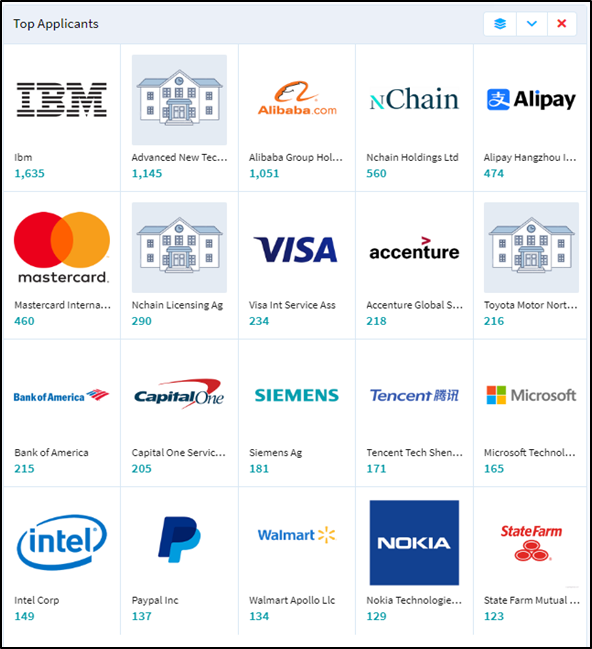

The chart provided underneath reveals that leading payment processors such as Mastercard, VISA, and Alipay, along with banks like Bank of America and Capital One, and an array of retailers and tech giants, stand out as prominent contenders for patent submissions in this domain.

Data of late has cast a clear light: the giants, those corporate behemoths, have been the most voracious seekers of patents tied to cryptocurrency and its kin, blockchain technology. Yet, to the budding enterprises and fledgling ventures, tread not in neglect. Consider, with utmost seriousness, patenting your pivotal technologies; these might very well be the linchpins to realizing your strategic visions.

Nuggets of Wisdom from the Frontlines of Patent Disputes

The battlefield of patent infringement, especially when it comes to crypto and blockchain, has remained more or less serene. But for the shrewd and discerning, there’s much to glean from skirmishes past, as they bear lessons weighty and critical.

When Rady threw down the gauntlet against the likes of Boston Consulting Group, LLC (BCG) and De Beers UK Limited, alleging infringement of U.S. Patent No. 10,469,250—a patent that presented a novel method using blockchain to chronicle the unique fingerprints of precious items—little did they know the storm that would ensue. The very marrow of their patent, the essence of recording to the blockchain, was struck down by De Beers, citing its abstract nature under the famous Alice decision.

In this tussle, Rady’s assertion of the patent’s novelty, citing its harmonious blend of computers, spectral analysis, and 3D recognition, was undone by its own precedent. The Court found resonance in the defendants’ arguments, pointing out the conventional nature of blockchain, much like Alice’s computer hardware.

Rady’s tale is a stark reminder that in the treacherous waters of blockchain innovation, the sanctity of patent eligibility stands as a formidable barrier. Craft your claims with precision and artistry, delineating their distinctiveness and your contribution beyond the mundane. This foresight could be your bulwark against challenges, be they during patent office scrutiny or in the heat of litigation.

Meanwhile, Lancium, holder of patents that finesse power consumption during crypto mining, found itself embroiled in another kind of battle. After alleging infringement by Layer1 Technologies, Inc., another storm arose when Bearbox LLC’s CEO sought to be recognized as a co-inventor of Lancium’s prized patent. The court’s discerning eye weighed the evidence—emails, timelines, claims—and sided with Lancium.

Bearbox’s saga underscores the intricate tapestry of patent inventorship. It behooves tech entities to fortify their processes, documenting with care each twist and turn of their invention’s journey. Solid agreements, robust IP clauses, and well-maintained timelines can serve as your defense against future altercations over rightful inventorship.

Beyond the drama of Rady and Lancium, myriad other patent considerations loom large in the realm of digital assets and blockchain technology. We’ve previously navigated the waters of “divided infringement” and ventured into the territory of extraterritoriality. As ever, we’ll keep our finger on the pulse, ensuring you’re abreast of the most noteworthy currents in this ever-evolving domain.

In examining the tales of Rady and Lancium, it’s clear that the patent landscape in the digital asset space is far from straightforward. These cases offer more than just cautionary tales; they provide vital insights for companies navigating this complex realm.

Firstly, the Rady case underscores the paramount importance of understanding the nuances of patent eligibility, especially in a rapidly evolving field such as blockchain technology. Companies should approach patent drafting with both innovation and thorough legal groundwork in mind, anticipating potential challenges. The ‘abstract’ nature argument can be a formidable one, and to counter it, businesses must emphasize and document tangible, technical benefits and novel applications of their solutions.

The Lancium dispute sheds light on the intricacies of patent ownership and the perils that can arise without clear documentation. Especially in an industry that thrives on collaboration and rapid development, delineating boundaries and responsibilities early on is crucial. Keeping meticulous records and maintaining transparent communications can save companies a great deal of legal strife.

Furthermore, companies should consider regular patent audits to ensure that their intellectual property is adequately protected and that they are not inadvertently infringing on others’ rights. These audits can identify potential vulnerabilities and opportunities, ensuring that a company’s innovations are both protected and compliant with the broader patent landscape.

In this vast and complex domain of digital assets and blockchain technology, Montague Law stands ready to guide you. Our expertise, honed by observing and analyzing landmark cases and evolving trends, ensures that you’re equipped with strategic and legal acumen.

Should you have any further queries or need a deeper dive into these matters, don’t hesitate to reach out. Contact Montague Law; we’re here to assist, elucidate, and ensure that you navigate this intricate landscape with clarity and confidence.