Short Answer:

A partnership buyout formula is a predetermined method used to calculate the value of a partner’s share in a business when they choose to leave or sell their interest. This formula typically considers factors like the company’s valuation, the partner’s ownership percentage, and any specific terms outlined in the partnership agreement.

Introduction & Background

With over a decade of experience as a corporate lawyer specializing in real estate, venture capital, mergers, acquisitions, and private equity, I’ve navigated the complex landscapes of business partnerships and their dissolution. My tenure at prestigious law firms, including Lowndes, Drosdick, Doster, Kantor & Reed, P.A., and Locke Lord LLP, has deepened my understanding of the intricate processes involved in partnership agreements and buyouts. Additionally, my role as an educator at the University of Florida’s Levin College of Law has allowed me to refine my knowledge and teaching skills in these areas.

Navigating a partnership buyout? Your pressing question is likely, ‘How do I calculate my partner’s buyout price accurately?’ The partnership buyout formula is your answer, empowering you to arrive at a fair buyout sum based on your partner’s equity share and the business’s valuation. We’ll delve into each element of this essential formula, offering clarity and guidance to ensure a fair and strategic buyout process.

In this article, I aim to dissect the partnership buyout formula – a crucial mechanism for calculating a partner’s share value when they decide to leave or sell their interest. Drawing from my extensive legal background, I will explore the key factors of this formula, such as company valuation and ownership percentage, and how they interplay to ensure a fair and equitable buyout process. This piece is not just an analysis but also a guide, born from years of professional experience in guiding clients through the nuances of partnership dynamics.

Key Takeaways

- The partnership buyout formula determines a fair buyout sum by calculating the departing partner’s equity stake and valuing the business, involving factors like contributions, earnings, assets, profits, and market share.

- Successful buyout negotiations hinge on fairness, precision, and avoiding common pitfalls, utilizing an independent valuation for an unbiased assessment of worth and crafting terms beneficial to all parties involved.

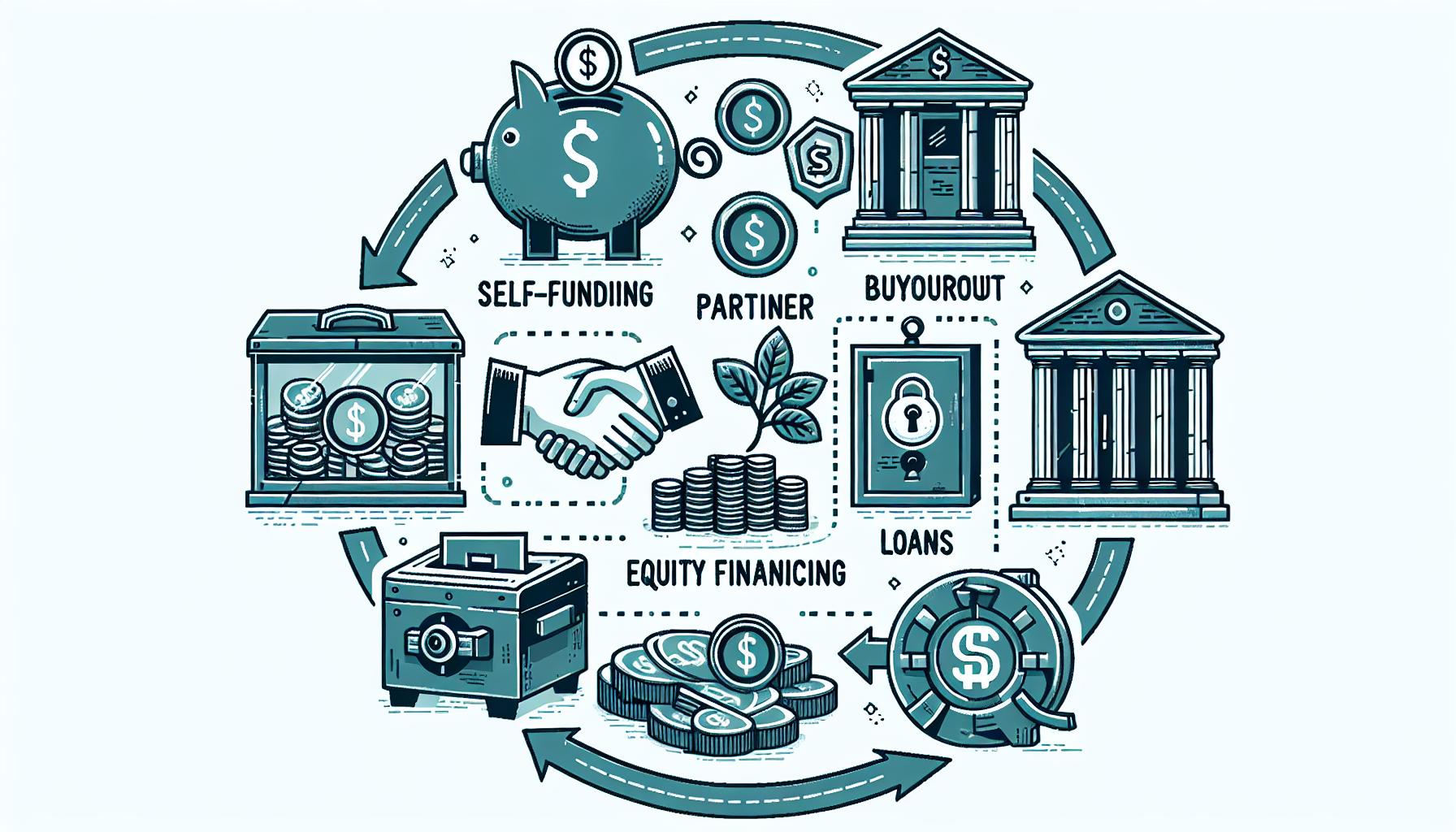

- Financing options for buyouts include self-funded strategies, installment plans with the exiting partner, traditional and SBA loans, and equity financing options, each with distinct advantages and risks.

Understanding the Partnership Buyout Formula

This buyout formula is the backbone of a successful business partner buyout. It’s a simple yet powerful tool, a straightforward calculation that can determine the financial fate of your business partnership.

The formula involves ascertaining your former partner’s equity stake, assessing the business worth, and determining the buyout sum.

Determining Your Partner’s Equity Stake

Your business partner’s expertise, coupled with the time and energy they’ve invested in the business partnership, translates into a tangible value: their equity stake. The equity stake of a former business owner or partner reflects their ownership, especially when one partner is planning to exit the partnership. The key determinants of a partner’s equity stake include total contributions of all partners, retained earnings, and the establishment of a total number of shares, all of which are influenced by the business partner’s expertise.

The initial investment made by a partner can significantly impact their equity stake in the partnership.

Valuing the Business

Assessing the business is a vital step in a business partner buyout. Establishing a fair market value is key to ensure a balanced allocation to the departing business partner buying out, acknowledging their skills and contributions. This process takes into account:

- Tangible and intangible assets

- Expected profits

- Sales and revenue

- Equipment

- Market share

- All partners’ creative and operational contributions

Consulting an independent business appraiser can help guarantee an equitable valuation.

Calculating the Buyout Amount

Once the equity stake is determined and the business is valued, the buyout amount can be calculated. This involves multiplying the partner’s equity by the business value, which is a crucial step in the partnership buyout process when you decide to buy out a business.

The buyout amount is directly influenced by the partner’s equity stake, which in turn, reflects their ownership percentage in the company.

Navigating Buyout Negotiations with Fairness and Precision

Negotiating a partner buyout is a sensitive process, requiring a balance between impartiality and accuracy to guarantee a smooth transition. Independent valuation has a significant role, offering an unbiased assessment of the partnership’s worth, aiding in setting realistic expectations and fostering productive negotiations.

The Role of Independent Valuation in Negotiations

Engaging an independent financial expert during a partner buyout helps reach a balanced agreement through an accurate assessment of the partnership’s worth, enhancing impartiality in the negotiation process. They bring to the table a thorough evaluation of factors such as:

- growth

- cash flows

- risks

- considerations of the economy

- historical earnings

- potential profit

- future market growth

This comprehensive evaluation ensures that all aspects of the partnership agreement are taken into account and helps facilitate a fair and equitable partnership buyout agreement, often referred to as a buy and sell agreement.

Crafting Mutually Beneficial Buyout Terms

Creating mutually beneficial terms in the buyout is both an art and a science. It requires clear communication, understanding each party’s needs, and finding a middle ground. The buyout terms should include clear delineation of the terms and conditions of the buyout, comprehension of the legal prerequisites, and alignment of the agreement with business objectives.

Avoiding Common Pitfalls in Buyout Negotiations

Steering clear of common pitfalls in buyout negotiations is a skill honed with experience and wisdom. Yet, even the most experienced partners can fall into traps without caution. Staying objective, managing emotions, and seeking professional advice is key to a smooth navigation through the process.

Financing the Buyout: Exploring Your Options

Financing the buyout often poses one of the biggest challenges in a business partnership buyout. It requires meticulous planning and a comprehensive understanding of diverse financing options. These options can be broadly categorized into self-funded strategies, partner buyout financing, and securing loans and equity financing.

Self-Funded Buyout Strategies

In a self-funded buyout strategy, the one buying out a business partner finances the entire buyout cost using personal funds. Despite seeming intimidating, this approach can lead to substantial cost savings and gives businesses more control over their financial health.

Partnership Buyout Financing Options

Partner buyout financing options can take the form of installment plans, with the exiting selling partner serving as a lender. This approach, though often convenient, comes with its own set of challenges, such as the risk of incurring high-interest costs and potential conflicts of interest.

Securing Loans and Equity Financing

To secure loans and equity financing for a partner buyout, one must consider traditional business loans and SBA loans, particularly the SBA 7(a) loan with partial guarantees from the U.S. Small Business Administration.

Equity financing can also be utilized through the sale of the exiting partner’s equity stake to private investors.

Legal Aspects of the Partner Buyout Agreement

A successful business partnership buyout is not just about the numbers and negotiations. It also requires a sound understanding of the legal aspects when buying out a business. This includes defining the scope of the buyout agreement, ensuring compliance with business law, and finalizing the agreement with professional assistance.

Defining the Scope of the Agreement

Defining the scope of the buyout agreement means detailing both the financial and non-financial terms. This includes:

- The purchase price

- Payment terms

- Valuation method to be used

- Non-financial terms, such as non-compete and non-disclosure agreements and IP ownership.

Ensuring Compliance with Business Law

Compliance with business law is a fundamental part of a partnership buyout. Early engagement of a business attorney is key to:

- Review the agreement

- Navigate state laws

- Assist in creating balanced terms

- Negotiate a fair price.

Finalizing the Agreement with Professional Assistance

The finalization of a partner buyout agreement includes the completion of essential documentation, including any legal addendums. A mergers and acquisitions lawyer can ensure compliance with legal requirements, structure the payment arrangement, and formalize the legally binding agreement.

Tax Considerations in Partnership Buyouts

One often overlooked aspect of the buyout is tax considerations, which include understanding tax liabilities upon buyout and planning for taxes in the buyout agreement.

Understanding Tax Liability upon Buyout

Understanding tax liability upon buyout involves:

- Consulting an accountant or tax advisor to determine the tax implications of the buyout

- The buyout amount is usually treated as a capital transaction

- It is subject to taxation as a capital gain at a lower tax rate compared to ordinary income.

Planning for Taxes in the Buyout Agreement

Planning for taxes in the buyout agreement requires outlining tax responsibilities and strategies for both parties. This includes strategies such as:

- Structuring the transaction to reduce or delay capital gains taxes

- Using installment sale agreements

- Using earnouts

- Using seller financing

Preparing for Life After the Buyout

Life post-buyout opens a new chapter for both the exiting and the remaining business partners, involving a transition in roles and responsibilities and an update in business plans and goals.

Transitioning Roles and Responsibilities

Transitioning roles and responsibilities requires clear communication and planning to ensure a smooth handover of tasks and authority. Here are some recommended best practices for transitioning roles during a partnership buyout:

- Leverage your experience and skills for the new role.

- Gain approval from the leadership for the transition.

- Evaluate the feasibility of the transition.

- Effectively oversee the transition process.

By following these best practices, you can ensure a successful transition of roles and responsibilities during a business partnership buyout.

Updating Business Plans and Goals

A change in business ownership often means a change in business direction, objectives, and strategies for future growth. New owners bring fresh perspectives and expertise, which can lead to changes in the direction and focus of the various business operations.

Reevaluating growth strategies after a buyout and aligning leadership with the plan is key to securing future success.

Summary

A partnership buyout is a complex process that requires careful planning, thorough understanding, and meticulous execution. From determining the partner’s equity stake to navigating buyout negotiations, financing the buyout, understanding the legal and tax implications, and preparing for life after the buyout, each step carries its own set of challenges and opportunities.

However, with the right knowledge and strategies, a partnership buyout can be a testament to sound business acumen and strategic foresight. It’s not just about the numbers and negotiations, but also about maintaining strong business relationships and setting the stage for future growth.

Frequently Asked Questions

How do you calculate buyout price?

To calculate the buyout price for your vehicle, simply add up the residual value, remaining payments, and any applicable fees listed on your monthly leasing statement.

How do you buy out a partner in a partnership?

You can buy out a partner in a partnership by making a lump sum payment with cash or business loans, or by structuring long-term payments over a period of time, such as monthly or quarterly payments for a few years.

What if my business partner wants to buy me out?

If your business partner decides he wants to buy you out, you should first consider whether you are willing to sell your ownership. If not, you may need to address the issue through legal means, such as enforcing a partnership buyout agreement or seeking resolution in court or arbitration. It’s important to understand your rights and the options available to you.

How do you value a business for a partnership?

When valuing a business for a partnership, consider methods such as asset valuation, discounted cash flow, and price-to-earnings ratio to determine its worth and potential earnings. This will help you make an informed decision regarding the partnership.

What financing options are available for a partner buyout?

You have several financing options available for a partner buyout, including self-funded strategies, partner buyout financing options, and securing loans and equity financing. Choose the option that best aligns with your financial goals and business needs.