How to Trademark a Name in Florida: what Entrepreneurs Need to Know

Florida Trademark Registration: A Comprehensive Guide for Entrepreneurs – Learn how to protect your brand’s identity with this detailed walkthrough of Florida’s trademark registration process. Covering state and federal registration, crafting a strong trademark, and navigating common challenges, this guide is a must-read for every Florida entrepreneur aiming for success.

Wyoming HB 19: Pioneering Crypto Regulation and Shaping the Future of Blockchain Innovation

Wyoming HB 19 amends the state’s Money Transmitter Act to exempt virtual currency transactions from licensing requirements. This strategic move lowers entry barriers for crypto businesses, attracting more to Wyoming, but it doesn’t exempt them from federal regulations. HB 19 positions Wyoming as a leader in blockchain innovation.

Wyo. Stat. § 40-22-104

Wyo. Stat. § 40-22-104 exempts government entities, financial institutions, and virtual currency transactions from specific Wyoming regulations, updated through 2023-2024 to reflect changing financial and tech laws.

Wyo. Stat. § 40-22-102

Wyo. Stat. § 40-22-102 Current through the 2023 Legislative Session (a) As used in this act:

Wyoming’s Trailblazing Path in Crypto Legislation: A Comprehensive Guide to Wyoming LLC Crypto Laws and Cases

Wyoming has positioned itself as a trailblazer in the domain of cryptocurrency and blockchain with its progressive Wyoming LLC crypto laws. Key legislation includes HB 19, exempting cryptocurrencies from the Money Transmitter Act, and HB 70, differentiating utility tokens from traditional securities. HB 101 encourages blockchain applications in business, while HB 126 and SF 111 focus on series LLCs and tax exemptions for virtual currencies, respectively. This robust legal framework makes Wyoming an attractive hub for crypto businesses and offers valuable insights into the evolving legal landscape of digital currencies and blockchain technology.

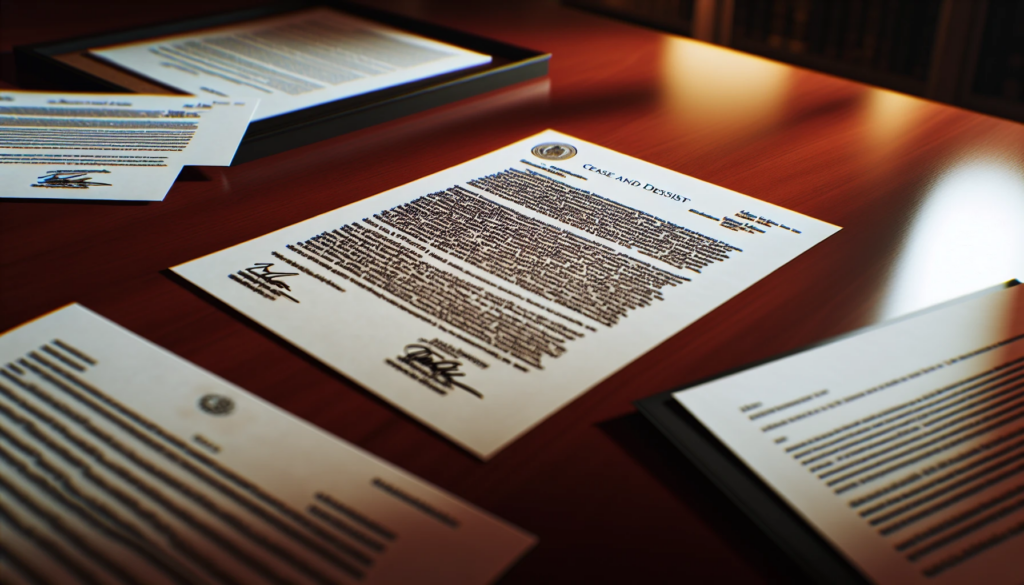

Section 78j – Manipulative and Deceptive Devices

In short, Section 78j of the U.S. Code prohibits manipulative and deceptive practices in securities transactions, outlining rules against fraudulent activities, insider trading, and specific trading strategies that could harm investors or the financial system.

Give us a call at

904-234-5653

or fill out the form below for a consultation.

"*" indicates required fields