In the world of emerging businesses born beyond the borders of the United States, there arises the call to reforge their roots on American soil. Among the reasons is a magnet for the bounty of funds. The U.S. venture capitalists, with their iron-clad conditions, often demand a change in domicile to Delaware corporations before they loosen their purse strings. Considering such predilection, foreign startups may decide on early migration to the U.S., preparing themselves for a swift absorption of venture capital, eliminating potential stumbling blocks in the process.

This piece lays out the blueprint to make such a switch from an international entity to a U.S. one, with Delaware as the new home base. The reasons for why Delaware serves as the optimal nest for venture-hungry startups will be unveiled in a forthcoming discourse.

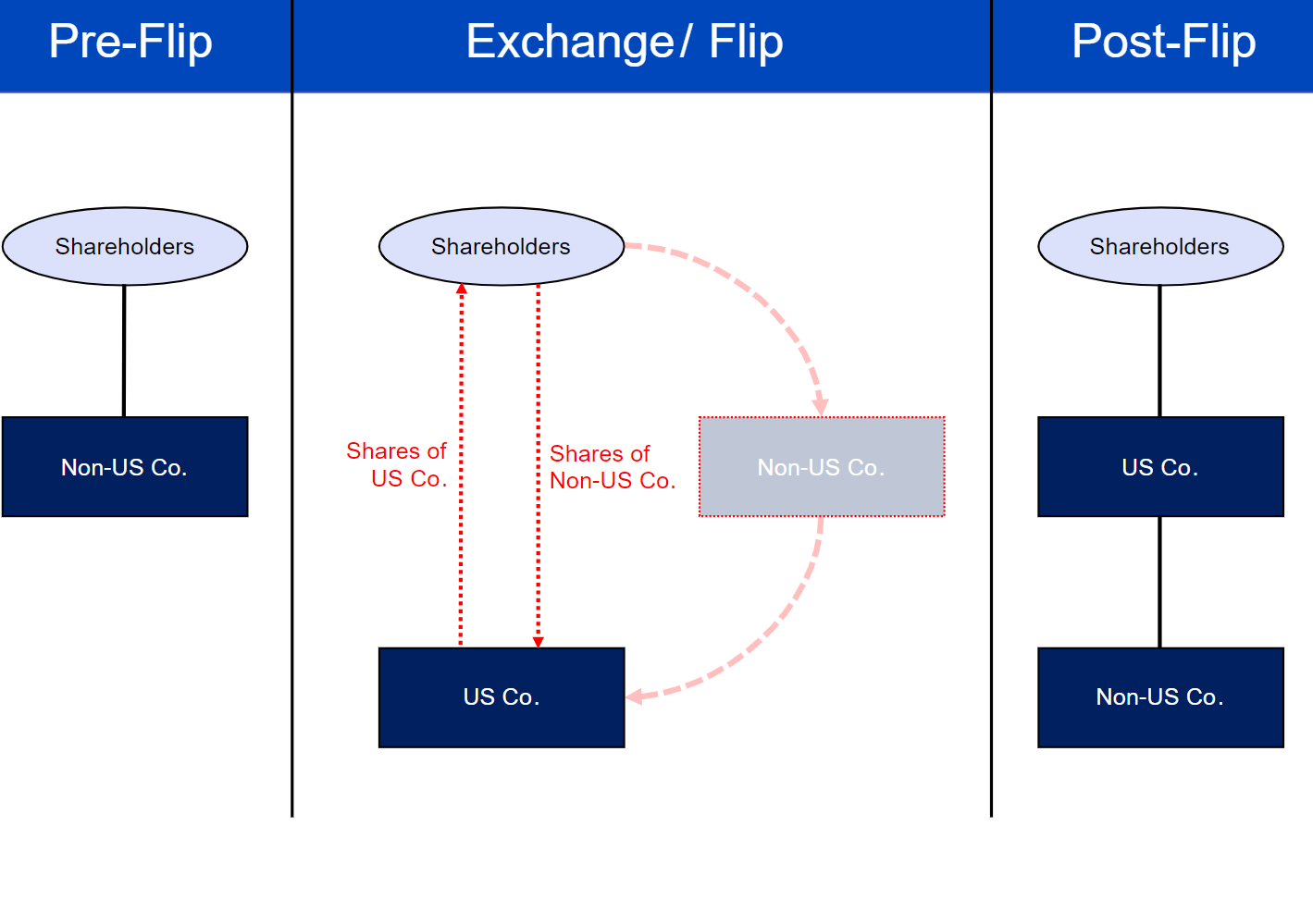

To effect a smooth transition, one could arrange a share-for-share exchange. This implies surrendering shares of the original company to acquire those of the freshly-minted U.S. corporation. The procedure involves:

- The birth of a new Delaware entity.

- The swap of the erstwhile non-U.S. shares for those of the nascent Delaware establishment.

The exchange could be struck on an equal footing or at a different ratio, say one-for-ten or one-for-a-tenth, to secure the desired share distribution post-exchange. Irrespective of the chosen rate, the principle remains: each shareholder will retain the same slice of the pie as before.

It’s not just the standing shares that make the jump. Convertible securities, options, warrants all take the plunge too, in adherence to the same exchange rate. Such an operation mandates the collective effort of all shareholders and equity holders. Hence, the timing of this maneuver must be well considered.

Post-transition:

- Shareholders will hold complete control over the new Delaware establishment.

- The new Delaware corporation will wholly possess the original foreign company, forming a parent-child relationship.

While the share-for-share swap is logistically seamless, tax implications could muddy the waters. The financial impact differs based on the unique tax norms of shareholder jurisdictions and the original enterprise. Ideally, the flip would be tax-neutral for both shareholders and corporations, maintaining the original tax attributes of the swapped shares. If such an arrangement risks a taxing outcome, alternate routes could be charted.

It’s crucial to understand that such a flip is essentially a one-way road in the U.S. tax landscape. The stringent anti-inversion norms of U.S. tax laws render any attempt to revert to a non-U.S. parent company futile. Such a company, though non-U.S. in name, would continue to be taxed as an American entity.

Shifting domicile to the U.S. is a formidable corporate move, demanding concerted effort and synchronization among the company’s stakeholders. The transition is simplest when the company is still in its infancy. As the company grows, the task gets progressively more intricate, encompassing legal, tax, and accounting challenges. Therefore, it’s highly recommended to secure professional legal, tax, and accounting advice for companies entertaining the idea of flipping to a U.S. jurisdiction.

To the budding entrepreneur, a move such as this could prove beneficial in a myriad of ways. With the U.S. venture capital landscape being as fertile as it is, the opportunity for startups to secure substantial funding significantly increases. This funding can fuel growth, advance research and development, and provide the essential backing needed to bring ambitious ideas to life. It is in the recognition of these opportunities that entrepreneurs may see the value of a flip to a U.S. entity.

Beyond the realms of financial gain, flipping to a U.S. entity could enhance an entrepreneur’s business network. The U.S. market is a pulsating hub of innovation, teeming with industry leaders, world-class talent, and trailblazing ideas. Entrepreneurs that immerse themselves in this ecosystem can cultivate connections that offer much more than monetary value. These interactions can lead to insightful mentorships, valuable partnerships, and an array of opportunities to learn from the industry’s best.

Moreover, operating as a U.S. company may grant entrepreneurs access to a larger market, opening doors to clients and consumers that may not have been previously reachable. This, coupled with the prestige that often comes with being a U.S.-based business, can make the company more appealing to prospective clients and customers, facilitating business growth.

However, it is crucial for entrepreneurs to navigate this path with care. Such a significant decision requires a deep understanding of both the potential benefits and the challenges involved. Expert guidance is essential to steer the complex landscapes of legalities, taxes, and administration, ensuring that the flip proves advantageous to the entrepreneur and their enterprise.