In the exciting realm of employee compensation, Nonstatutory Stock Options (NSOs) are an intriguing player. Offering an opportunity to buy company stock at a predetermined price, they create a potential pathway to profit for both employees and non-employees alike. But like any financial instrument, NSOs come with their own set of benefits and risks. Ready to dive in? Let’s unravel the world of NSOs together.

Key Takeaways

- Nonstatutory Stock Options (NSOs) offer flexibility and potential for profit, but require understanding of the rules, processes, tax implications and market value.

- Employers can use NSOs to reward talent without cash outlay. Employees must weigh prospects against risks before exercising options.

- Selling strategies should be based on individual financial situation & expert advice is recommended when handling NSOs.

Understanding Nonstatutory Stock Options (NSOs)

Nonstatutory Stock Options, also known as non-qualified stock options, offer a distinctive opportunity to both employees and non-employees. By providing the option to purchase a company’s stock at a pre-established price, NSOs present a potential avenue for profit. This is particularly true if the company’s stock price rises significantly after the options are granted.

However, it’s not just about the potential for profit. NSOs also come with their own set of rules, processes, and tax implications. A thorough grasp of NSOs’ intricacies is required to navigate their world effectively. We start by defining NSOs and examining their primary characteristics, then proceed to the eligibility requirements and granting procedure.

Definition and Key Features

Non statutory stock options, also known as Nonstatutory Stock Options (NSOs), are a type of employee stock option. They do not meet the criteria for tax-advantaged treatment. Instead, they incur taxation at the time of the option exercise. This separates them from other types of employee stock options, such as Incentive Stock Options (ISOs), which receive more favorable tax treatment.

One of the distinctive features of NSOs is their flexibility. Unlike other types of stock options, NSOs can be granted to a wide range of individuals. This includes:

- employees

- consultants

- advisors

- directors

This makes NSOs a versatile tool for companies looking to incentivize a wider circle of individuals.

Eligibility and Granting Process

When it comes to eligibility for NSOs, there is a wide range of potential recipients. While they are often granted to higher-paid employees, NSOs can also be awarded to:

- Non-employees as part of a compensation package

- Contractors

- Suppliers

- Lawyers

among others.

The process of deciding who receives NSOs is typically based on a person’s role or status within the company. This means that not just employees, but also outside service providers like advisors, board directors, or consultants could be granted NSOs. Remember, there are prescribed rules for awarding NSOs to non-employees, and consulting legal and tax professionals for accurate guidance is essential.

The Exercise Saga: From Grant Date to Market Value

Exercising NSOs is a journey that starts from the grant date and culminates with the market value at the time of exercise. The exercise price, or the grant price at which the stock option can be exercised, plays a crucial role in this process. This price is typically established at the fair market value of the stock at the grant date, and its determination is influenced by a variety of factors such as:

- The current market price of the stock

- The expected future performance of the company

- The volatility of the stock price

- The time remaining until the option expires

Considering these factors is important in order to make an informed decision about when to exercise your NSOs.

However, knowing the exercise price is only half the story. The other half lies in timing the exercise of the NSOs. The timing of the exercise can significantly affect the potential profit and tax implications. Comprehending these factors allows you to make an informed decision about when to exercise your NSOs.

Understanding the Exercise Price

The exercise price of NSOs, often set as a fixed price, is a key factor in determining their potential profitability. It represents the predetermined price at which the stock option can be exercised. This price is usually set at the fair market value of the stock at the grant date.

However, the exercise price isn’t just a static number. It plays a crucial role in influencing an employee’s decision to exercise their NSOs. If the exercise price is lower than the current market price of the stock, employees are incentivized to exercise their options to gain profit. Conversely, if the exercise price exceeds the market price, exercising may result in a financial loss.

Consequently, grasping the exercise price is paramount for maximizing the benefits of your NSOs.

Timing Your Move: When to Exercise

Deciding when to exercise NSOs is a dynamic process. It involves considering changes in personal tax situations and market value of the stock. For instance, fluctuations in personal tax rates or brackets can create scenarios where it’s advantageous to exercise NSOs when tax rates are lower.

But it’s not just about taxes. The market value of the stock at the time of exercise also plays a significant role. It’s generally advantageous to exercise NSOs when the market value of the stock exceeds the exercise cost. This allows the option holder to immediately capture the stock option value. Thus, monitoring market trends and tax implications is crucial for correctly timing your move.

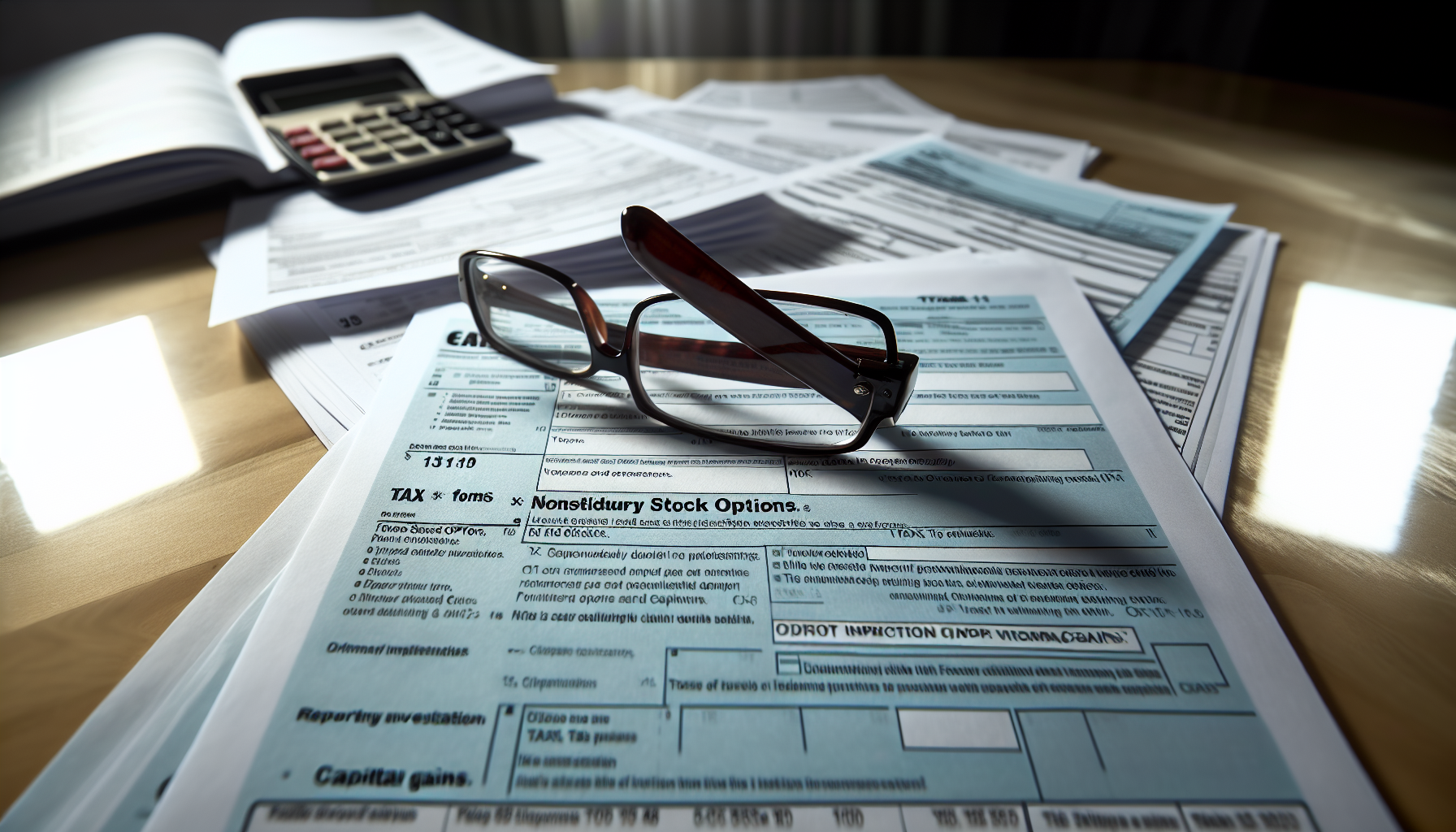

Tax Implications of NSOs: Navigating Ordinary Income and Capital Gains

Like any financial instrument, NSOs come with their own set of tax implications. The exercise of NSOs triggers taxation on the difference between the fair market value at the time of exercise and the strike price, which is treated as ordinary income. This means that the option holder is required to pay ordinary income tax on this amount.

However, NSOs’ tax implications extend beyond the exercise phase. Following the exercise of NSOs, if the shares are sold immediately, only ordinary income tax on the spread is applicable. However, if the shares are sold within a year of exercise, the profit is subject to short-term capital gains tax. And if held for over a year, it is subject to long-term capital gains tax.

At Exercise: Paying Ordinary Income Tax

Ordinary income tax, including state income taxes, plays a significant role in the taxation of NSOs. Upon exercising NSOs, the difference between the fair market value and the exercise price is taxed as ordinary income. This means that the option holder is required to pay tax on this amount.

But who’s responsible for remitting this tax? Typically, the company is tasked with withholding the ordinary income tax on the compensation element (the spread) at the time of the employee’s NSO exercise. The compensation element is subject to ordinary income taxation and should be reported on Form W-2.

Post-Exercise: Potential Capital Gains

After exercising NSOs, the tax landscape shifts from ordinary income to capital gains. Any profits generated from the sale of the shares are governed by the rules of capital gains tax. The calculation of capital gains involves deducting the fair market value of the stock on the day of purchase from the sale price.

However, it’s not merely a straightforward calculation. The capital gains tax rate is contingent upon the duration for which the stock was held prior to its sale. Gains from stocks held for over one year are subject to long-term capital gains tax, usually at a lower rate than short-term capital gains tax, which applies to shares sold within a year of exercise.

Comparing NSOs and ISOs: Tax Benefits and Limitations

While NSOs are a valuable tool in the realm of employee compensation, they aren’t the only type of stock options out there. One alternative presented is Incentive Stock Options (ISOs). They offer a different option in this scenario. They differ from NSOs in their tax treatment, with ISOs offering potential tax benefits that NSOs do not.

Nonetheless, ISOs have their own inherent disadvantages and risks. Some of these include:

- Complications with tax withholding

- The potential triggering of the Alternative Minimum Tax (AMT), which can impact the tax benefits

- Unlike NSOs, ISOs are exclusively available to employees and have specific holding period stipulations to achieve their tax benefits.

Strategic Considerations for Employers and Employees

NSOs are not just about the potential for profit or tax implications. They also have strategic implications for both employers and employees. Employers, for instance, can use NSOs to incentivize a wider range of individuals without requiring immediate cash expenditure. They provide financial advantages including enhanced compensation flexibility, tax benefits, and employee retention.

On the other hand, employees need to weigh the potential benefits and risks of NSOs. These can include increased income, the opportunity to make more money as the stock price rises, and the potential for significant return on investment. However, they also come with risks, including capital gains taxes, company failure, and concentration risk.

Regardless of whether you’re an employer or an employee, comprehending these strategic considerations can assist you in maximizing the benefits of NSOs. Now, let’s examine these considerations for both employers and employees in greater detail.

For Employers: Rewarding Talent without Immediate Cash Outlay

For employers, NSOs can serve as a strategic method to incentivize talent without requiring immediate cash expenditure. They provide:

- Flexibility in awarding them to different individuals

- No limit on the value that can be granted

- A strong incentive, particularly for individuals in early-stage pre-IPO companies.

Moreover, NSOs assist employers in retaining talent by offering employees an ownership stake in the company. They can also function as a form of deferred compensation to retain crucial talent. In essence, NSOs offer employers a cost-effective way to reward employees without offering immediate cash compensation.

For Employees: Weighing the Prospects and Risks

For employees, NSOs offer a unique opportunity. They provide increased income without additional expense for the employer, the chance to benefit from rising stock prices, and the potential for significant return on investment compared to cash bonuses. But with these potential benefits come potential risks. These include capital gains taxes, tax implications, company failure, and concentration risk. Hence, employees must consider these risks and solicit expert advice when handling NSOs.

Selling Strategies: When to Hold and When to Fold

Once you’ve exercised your NSOs, the next big question is: should you sell or hold? This decision can significantly impact your potential profits and tax implications. Generally, it’s advisable to consider exercising and selling NSOs when they are significantly above the exercise price.

However, deciding when to sell is not just about looking at the stock price. It’s also about considering your own financial situation and risk tolerance. If you have previously exercised shares and currently hold a substantial amount of the company’s stock, it might be time to start diversifying your holdings. This can help mitigate concentration risk in your investment portfolio.

Regardless of your decision to sell immediately or retain for the long term, having a strategy is essential. This involves deciding when to hold or sell the shares, as well as diversifying investments post-exercise. Now, let’s explore these strategies in more depth.

Immediate Sale vs. Long-Term Holding

Choosing between an immediate sale or long-term holding of NSOs can have a significant impact on your potential profits and tax implications. Selling immediately after exercise can provide immediate cash value and less restrictive tax provisions. However, it also means missing out on potential future gains and possibly incurring a high tax bill.

On the other hand, holding onto the shares post-exercise allows you to potentially benefit from future stock price increases. However, this decision should be made in light of market conditions and your own financial situation. In a volatile or declining market, it might be wiser to sell to secure gains and reduce potential losses.

Diversification Tactics Post-Exercise

After exercising NSOs, diversifying your investments can help manage risk and optimize returns. Diversification involves spreading your investments across various assets and market sectors, which can decrease the volatility of your investment portfolio.

Effective diversification strategies include diversifying into a mix of different investments, employing dollar-cost averaging, and setting target allocations for various asset classes. It’s also crucial to stay informed about company performance, industry trends, and broader market risks to make better investment decisions.

Consulting the Experts: When to Seek Advice

Navigating the world of NSOs can be complex. That’s why consulting experts can be invaluable. They can help you with:

- Understanding the tax implications

- Understanding the complexities of NSOs

- Financial planning considerations

- Assessing your individual circumstances

By consulting an expert, you can effectively navigate these factors and make a well-informed decision.

Regardless of your role as an employer or employee, seeking advice from a tax advisor and a financial professional is recommended when handling NSOs. They can provide you with tailored advice based on your individual circumstances and help you navigate the complexities of NSOs.

Summary

In conclusion, Nonstatutory Stock Options offer a unique opportunity for both employers and employees. They serve as a strategic tool in employee compensation, providing potential profits, tax implications, and strategic considerations. Whether you’re an employer looking to incentivize talent without immediate cash outlay, or an employee weighing the prospects and risks, understanding NSOs is crucial to maximizing their benefits. Remember, when it comes to NSOs, knowledge is power.

Frequently Asked Questions

What is a nonstatutory stock option plan?

Nonstatutory stock options, also referred to as non-qualified or NSOs, are employee stock options given without restrictions that allow individuals to purchase company stock at a preset price at a later date. They are not part of an employee stock purchase plan and typically defer taxes until the options are exercised.

What is the difference between a nonstatutory stock option and a RSU?

Nonstatutory stock options (NSOs) give you the right to buy stock at a predetermined price, whereas restricted stock units (RSUs) are actual shares that you acquire as they vest. This means that NSOs may never be exercised if the company’s valuation falls below the strike price, while RSUs automatically grant ownership of the shares upon vesting.

What is the difference between statutory and non statutory options?

Statutory stock options provide an additional tax advantage not offered by nonstatutory stock options, as the former are typically not taxed until the taxpayer disposes of the options and any gains on the disposition are then taxed as capital gains. Nonstatutory stock options, on the other hand, are not given favorable tax treatment and must come with a document denoting how many options are allotted to which employees.

What is basis in nonstatutory stock options?

The cost basis of nonstatutory stock options is the sum of the exercise price multiplied by the number of shares exercised, plus any ordinary income reported on a W-2. This combined amount is your original cost and must be reported as compensation income on your Form 1040.

What are the tax implications of exercising NSOs?

Exercising NSOs triggers taxation on the difference between the fair market value and the strike price, which is treated as ordinary income and must be paid by the option holder.