Short Answer:

Data room investment happens in secure, organized platforms essential for due diligence, offering a comprehensive view of a startup’s fiscal health and operations. They simplify the analysis process, ensuring a secure exchange of confidential documents, crucial for informed investment decisions in transactions like fundraising and M&A.

Introduction & Background

In the intricate world of investment, understanding and leveraging the power of investor data rooms is crucial for due diligence and ensuring a comprehensive analysis of a startup’s operational and financial health. M extensive background in law, particularly in major real estate transactions and venture capital, M&A, and private equity transactions at AM Law 200 firm Locke Lord LLP, has afforded me a deep understanding of the importance of secure, organized information exchange in financial transactions. This experience makes me uniquely qualified to discuss the strategic advantage of well-designed data rooms in facilitating informed investment decisions, ensuring that potential investors have all necessary data at their fingertips in a secure, efficient manner.

Having served as an associate at Lowndes, Drosdick, Doster, Kantor & Reed, P.A., and taught Entrepreneurial Law classes at the University of Florida’s Fredric G. Levin College of Law, I have witnessed firsthand the evolution of data rooms from physical repositories to their modern, virtual counterparts. This transition to digital has revolutionized the way confidential company documents are shared and analyzed, underscoring the necessity of robust security measures and streamlined access to information. My journey through the realms of legal and investment frameworks has solidified my belief in the critical role that well-structured investor data rooms play in the due diligence process, making it a foundation upon which transparent, efficient, and secure financial transactions are built.

Key Takeaways

-

Investor data rooms play a crucial role in due diligence, allowing for secure sharing of a startup’s detailed financial and operational information, which facilitates better-informed investment decisions.

-

Setting up a virtual investor data room involves choosing a secure and user-friendly platform, meticulously organizing documents, and implementing access control and security measures to protect sensitive data.

-

Data rooms are essential for managing M&A due diligence, providing a secure, centralized platform for remote access to transactional documents, and enhancing decision-making while maintaining confidentiality.

The Importance of Data Room Investment

Within the detailed realm of investment, investor data rooms serve as the foundation for due diligence, offering investors a comprehensive view of a startup’s operations and fiscal health. Visualize a unified, well-arranged repository where all crucial information is readily accessible—this is the advantage of a well-designed data room. A well-structured data room enables potential investors to perform an exhaustive analysis with increased simplicity and thoroughness, leading to better-informed decisions.

The secure exchange of confidential company documents is the lifeline of any financial transaction, be it fundraising, legal proceedings, or audits. Data rooms don’t just facilitate this exchange of confidential business information; they safeguard it. With a virtual data room, the integrity of sensitive data is maintained, allowing additional investors and decision-makers to verify the fine details of a prospective investment with peace of mind. This isn’t just a feature; it’s a necessity in today’s fast-paced, data-driven investment landscape.

Setting Up an Investor Data Room

Establishing an investor data room is comparable to building a digital stronghold for your most precious assets. Gone are the days of physical data rooms with their inherent limitations and security risks. Today’s virtual data room is a secure and cost-efficient solution that provides more than just storage; it’s a comprehensive platform for confidential information sharing with potential investors. It’s a dynamic space that can be personalized with your company’s branding, enhancing recognition while providing a tailored experience.

What’s more, it incorporates robust security measures to protect your data, alongside user-friendly features that ensure a smooth due diligence process for venture capitalists and potential investors alike.

Selecting the Right Platform

On the journey to find the ideal virtual data room, choosing the correct platform is an essential initial step. It must be a bastion of security features, user-friendliness, and cost-efficiency. Take FirmRoom, for example, a platform lauded for its stringent security compliance with SEC, SOC 2, and FINRA regulations, ensuring your organization’s sensitive information and data is under lock and key. However, every rose has its thorn, as seen with IntraLinks, which, despite its merits, has faced criticism for less advanced security measures and usability challenges.

Then there’s DataSite, the epitome of a user-friendly experience, boasting features like tracker functionality, email system integration, and AI-assisted document handling that simplifies the data room experience. When weighing the options, the cost is a significant factor, but it must be considered alongside the aforementioned features to ensure you’re investing in a platform that aligns with your business model and delivers the appropriate level of security and functionality.

Organizing Documents

An investor data room extends beyond being just a storage area; it’s a neatly arranged online repository that mirrors your company’s devotion to transparency and orderliness. Creating a hierarchical structure with main categories and subfolders, complemented by standardized document names, transforms a jumbled mess into a navigable library of information. This level of organization showcases a startup’s professionalism and paves the way for smooth communication with potential investors during the fundraising process, making it an ideal data room for investors.

Tagging documents with metadata is not just about advanced search capabilities; it’s about equipping legal teams, contract workers, and other team members with the tools to:

-

Share confidential documents efficiently and securely

-

Easily find sensitive documents

-

Ensure necessary documents are right where you expect them to be

-

Streamline the entire due diligence process

The right organization within your organized data room can help achieve these goals.

Implementing Security Measures

Security is the fundamental aspect of any investor data room. Implementing robust encryption methods and adhering to regulatory compliance, such as ISO and FINRA standards, is the best practice to safeguard your corporate data. Access control mechanisms take this a step further, allowing you to fine-tune who sees what, ensuring that sensitive information is only accessible to those with the right to view it in a secure location.

Watermarking documents within the data room adds another layer of defense, deterring unauthorized sharing of certain documents and tracing any breaches back to the source. These security measures form a secure space where the due diligence process can proceed without fear of compromised data, ensuring that the data room remains a bastion of confidentiality and trust.

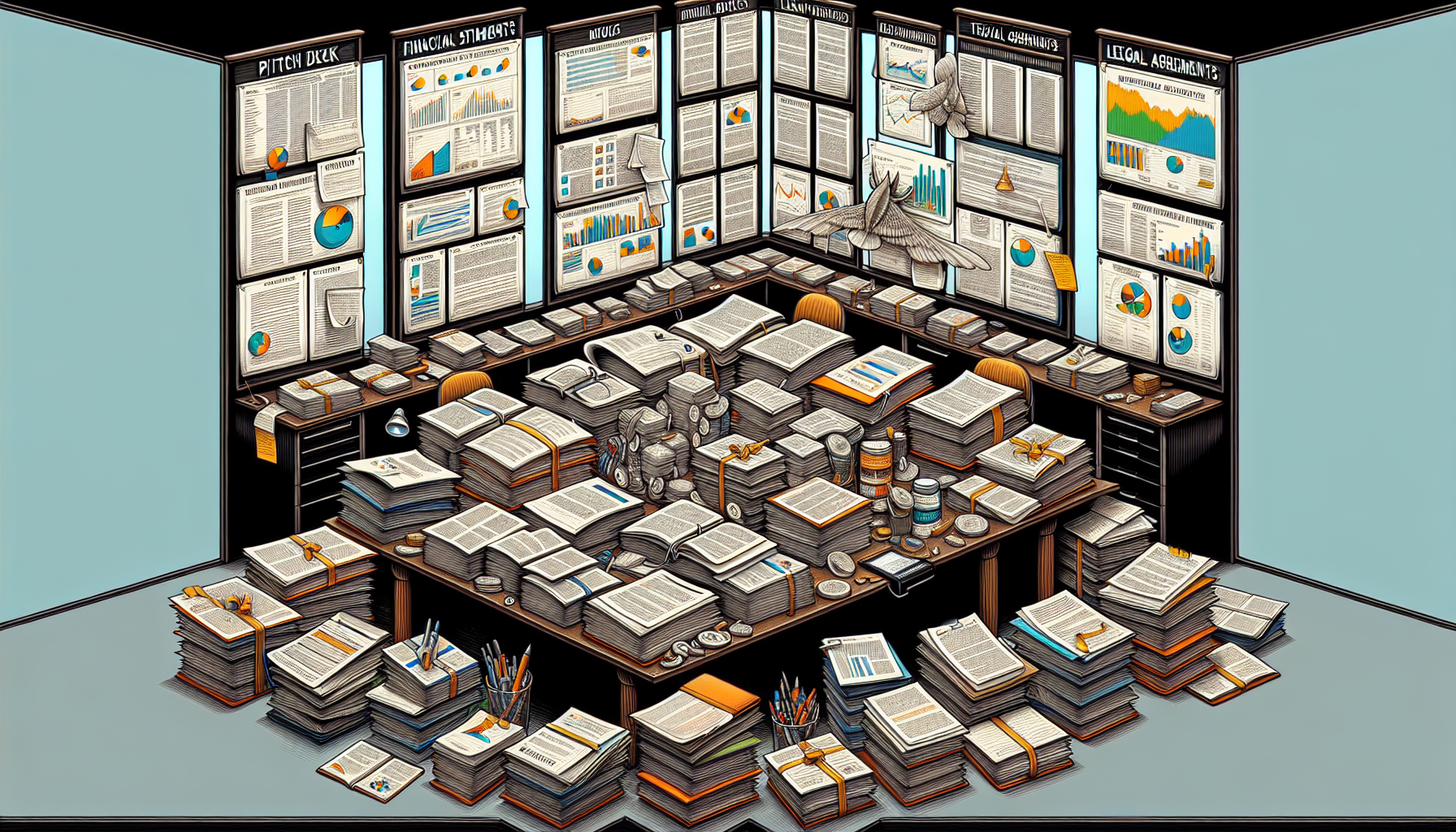

Key Documents to Include in Your Data Room

The documents stored within define the essence of your data room. To paint a vivid picture of your company’s trajectory and potential, include a pitch deck that encapsulates your overall business plans. But it doesn’t stop there. Financial documents like balance sheets, financial statements, P&L statements, and financial models are the pulse that shows the financial health and future projections of your enterprise.

Legal documents, such as investor rights agreements and records of board meetings, lay down the legal and governance framework, while intellectual property documents underscore the value of your intangible assets. Employee-related documentation, including contracts and confidentiality agreements, reveals the company’s human resource policies and commitments, completing the comprehensive data room that potential investors expect.

Managing Access and Permissions

Who has access to which data and when? These are fundamental queries in the administration of data rooms. Defining user roles and access levels is not just about data security; it’s about ensuring that sensitive information stays within the circle of trust. From granting view-only access to board members to full access for legal teams, the user’s role within the company dictates their level of interaction with the data room’s contents.

It’s a delicate balance to strike, but one that is necessary to prevent breaches and maintain the integrity of your data security measures.

Defining User Roles

Virtual data room security is comparable to a chess match; each piece has a designated role and range of motion. Defining user roles ensures that every team member, from board consents to other team members, has access privileges that match their duties and responsibilities. This not only protects critical corporate data but also streamlines the workflow by preventing unnecessary access to sensitive information.

With tools to monitor activities within the data room, the management can track user interactions and handle approval processes for new user requests with precision. These monitoring tools are not just safeguards; they provide a transparent window into the inner workings of the data room, ensuring every action aligns with the company’s data security protocols.

Monitoring Activity

The diligence process in investment management is a journey that must be safeguarded at every step. Regular reviews of the data room’s activity log serve as checkpoints, ensuring that the path remains clear of security threats and that the balance sheet of trust remains unblemished. These logs offer insights into not just the most viewed information but also the changes made by parties within the data room, which can be crucial for addressing any potential issues proactively.

While individual users can view the contents of the data room, their visibility does not extend to the activities of others, maintaining a level of confidentiality and focus on their specific role. Investment bankers, in particular, find value in tracking the time spent by each individual within the data room, using analytics data from platforms like DealRoom to assess investor engagement and inform necessary changes for a successful deal.

Leveraging Data Room Analytics

Analytics in a data room function as a compass, navigating you through the terrain of investor interest and engagement. By analyzing which documents are garnering the most attention, you gain insights that can shape your strategic approach and highlight areas of particular interest to potential investors. Real-time data on user interactions with specific documents also brings a level of transparency and accountability to the investment process that was previously unattainable.

For the savvy investment banker, these analytics are a tool to forecast engagement, do competitive analysis, pinpoint investor concerns, and proactively address issues that could otherwise derail a deal. Built-in analytics provide a competitive edge, transforming raw data into actionable insights that ensure your data room is not just a repository, but a dynamic, interactive tool in the art of deal-making.

Maintaining and Updating Your Data Room

A data room is a dynamic entity that needs consistent upkeep to stay efficient and secure. Here are some important tasks to keep in mind:

-

Conduct routine audits to identify any unusual patterns or suspicious behavior that could signal a security breach.

-

Keep documents up to date by regularly reviewing and updating them. Remove outdated versions promptly.

-

Ensure that the data room contains the most current and relevant information.

By following these tasks, you can maintain an efficient and secure data room.

Regularly reviewing access to the data room is a critical practice, akin to changing the locks on a safe. Removing access for those who no longer require it is a necessary step to prevent unauthorized entry and maintain the integrity of your data room. Additionally, by maintaining an organized structure with a master index, you ensure that the data room remains a secure, navigable, and efficient tool for all users.

The Role of Data Rooms in Mergers and Acquisitions

In the strategic game of mergers and acquisitions (M&A), the data room serves as the platform where vital decisions are made. It is the centralized hub where all important transactional documents are kept, allowing buyers and attorneys to access and scrutinize every detail with ease. While traditional data rooms allowed for controlled access, they limited the process to one bidder’s team at a time, whereas virtual data rooms facilitate a more dynamic and confidential due diligence process.

The evolution from physical documents to virtual data rooms has been a game-changer, enhancing due diligence by:

- Allowing remote review and exchange of confidential documents, which minimizes the need for physical travel and paperwork

- Offering a secure platform that protects the sensitive information involved in M&A transactions

- Maintaining strategic partnerships and ensuring successful deal closures

Beyond convenience, data room software has revolutionized the way businesses handle their confidential information through virtual data rooms, as compared to traditional data room methods.

Summary

As we’ve navigated the digital corridors of data rooms, it’s clear that their role in investment management is both foundational and transformative. From the meticulous organization of documents to the vigilant management of access and permissions, the modern data room is an indispensable tool for investors. Whether in daily operations or complex M&A transactions, the data room remains the secure bastion where critical information is exchanged, analyzed, and protected. Let this be your guide to mastering the art of data room investment management, and may your journey be as secure as the data within these virtual walls.

Frequently Asked Questions

What is data room for investors?

A data room for investors is a storage space, digital or physical, used by companies to store information relevant to due diligence and other valuable data during an acquisition process. It helps investors ensure everything is in order.

What is a data room fundraising?

A data room for fundraising is a storage space where companies keep important information for due diligence, such as when an enterprise wants to buy a company, helping investors ensure everything is in order.

Why are data rooms so expensive?

Data rooms are expensive because providers charge based on the amount of storage space required, with larger storage needs resulting in higher costs. This is due to the pricing structure of virtual data room providers.

How does a virtual data room differ from a traditional physical data room?

Virtual data rooms differ from traditional physical data rooms in terms of accessibility, cost-effectiveness, and security features. Physical data rooms require documents to be accessed in person, while virtual data rooms allow for secure and remote sharing of confidential documents.

What are some essential documents to include in a data room?

Essential documents to include in a data room are financial statements, pitch decks, business plans, legal agreements, intellectual property documentation, and employee-related information. They offer a comprehensive overview of the company’s health, legal standing, and potential.