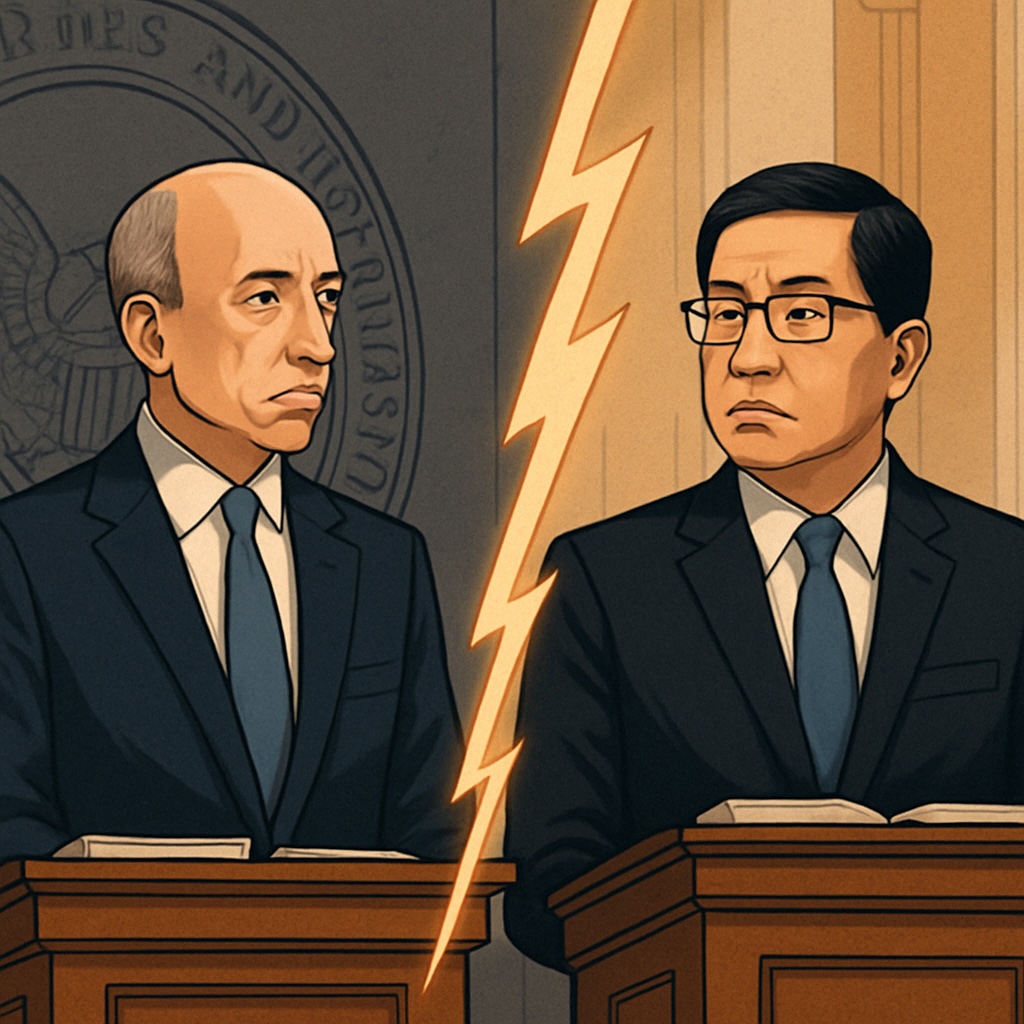

SEC Commissioners Are Subtweeting Each Other—and Crypto’s Caught in the Crossfire

A quiet footnote from SEC Chair Gary Gensler just sparked a not-so-quiet rebuke from Commissioner Mark Uyeda—exposing deep rifts inside the agency over how to regulate crypto. With no clear rules and rising public tension, the SEC’s internal divide may be the biggest threat to digital asset clarity yet.

X’s New Block Policy: A Double-Edged Sword for User Privacy and Platform Transparency

X’s quiet update to its blocking feature means users you block can now still see your posts. While framed as a win for transparency, this shift could have real legal and safety implications—from harassment risks to potential violations of app store policies.

New SEC No-Action Letter for Offerings Under Rule 506(c)

A new SEC no-action letter may make it significantly easier for issuers to verify accredited investor status in Rule 506(c) offerings. Learn how investor representations, check size, and a lack of red flags could streamline compliance—and what limits still apply.

Robo-Due Diligence: Top Legal Issues in Robotics Venture Capital

From open-source license landmines to product liability nightmares, investing in robotics isn’t your typical venture play. This article dives into the real legal and strategic issues VCs face in robotics—from IP tangles and regulatory fog to murky moats and malfunctioning hardware. If you’re funding the future, start here.

Technology in M&A

In tech M&A, the biggest risk isn’t hidden in the numbers—it’s buried in the code. Technology classification is the key to understanding what you’re really buying. From open-source exposure to IP gaps, this process protects valuation, streamlines diligence, and ensures clean, enforceable deals. Here’s how to get it right.

Navigating ECCN 5D002: A Practical Overview for Technology Exports

Ensure compliance with ECCN 5D002 to avoid fines and sanctions when exporting encryption software. Understand licensing, exceptions, and best practices.

Give us a call at

904-234-5653

or fill out the form below for a consultation.

"*" indicates required fields