Venture capital investment is an exhilarating realm in which budding ideas can evolve into flourishing enterprises, capable of revolutionizing not only the lives of entrepreneurs but also the industries in which they function. It is crucial for anyone contemplating securing venture capital to comprehend the stages involved in this investment process, as this knowledge can significantly bolster their chances of success. So, are you prepared to traverse the fascinating landscape of venture capital and delve into its stages?

Whether you’re an entrepreneur holding a potentially revolutionary concept, an investor on the lookout for the next blockbuster investment, or simply an individual intrigued by the mechanisms behind startup financing, this article caters to your interests. We’ll delve into the multifaceted stages of venture capital investment, spanning from the embryonic pre-seed phase to the sophisticated mezzanine stage. Together, we’ll unlock the pivotal elements integral to thriving in this high-octane, reward-rich arena.

Upon concluding this article, you’ll possess an all-encompassing knowledge of venture capital investment’s early stages, empowering you to traverse this intricate terrain with assurance. Without further ado, let’s embark on this enlightening journey, unwinding the captivating intricacies of venture capital.

Short Summary

- Venture capital investment, while laden with substantial risk, possesses the capacity to provide startups with significant avenues for growth.

- Achieving success in the venture capital sphere necessitates the presence of a robust management team, specialized expertise, an aptitude for judicious risk-taking, and thorough due diligence.

- Businesses seeking alternative avenues for funding can consider options such as self-funding, loans, and angel investments, which can bolster their pathway to success.

Venture Capital: An Overview

Venture or venture capital fundraising is a form of private equity financing offered by firms to fledgling companies with considerable growth potential. The primary purpose of venture capital is to enable promising entrepreneurs, who may have limited or no operating history, to acquire capital to initiate their business. But, as with any investment, there are risks involved. Venture capital investments are typically associated with high risks due to the uncertain nature of new businesses.

Early-stage venture capital funding often goes through several stages. They typically involve pre-seed, seed, series A, and series B rounds of funding. Additionally, there are two types of venture capital available: early-stage seed capital and expansion funding. Understanding each stage is crucial for both entrepreneurs and investors to make informed decisions and navigate the complex world of venture capital investments.

As an entrepreneur or investor, it is essential to be aware of the stages of venture capital and their associated risks. With this knowledge, you can better assess the potential of a startup and make more informed decisions about whether to invest or seek funding. So let’s explore each funding stage here in detail to better understand the venture capital investment process.

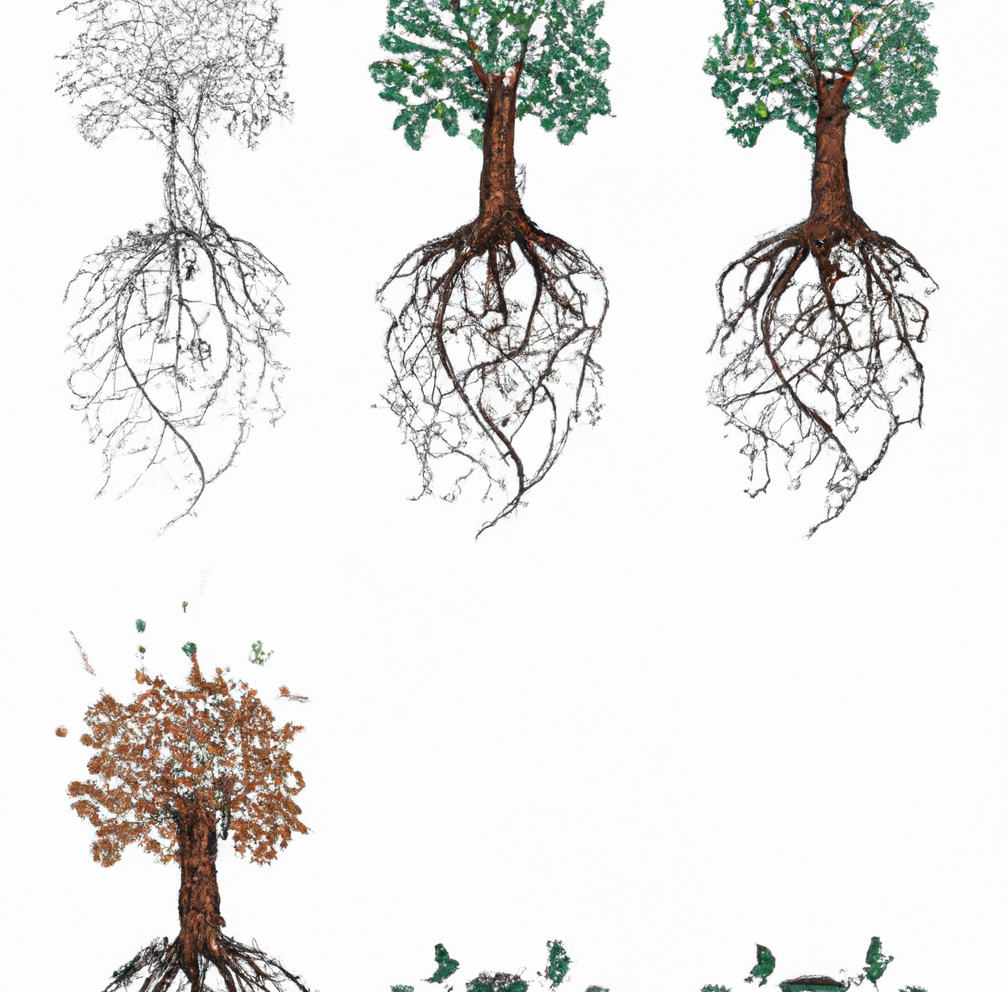

The Pre-Seed Stage: Laying the Foundation

Venture capital fundraising, a subset of private equity financing, extends a lifeline to nascent companies brimming with exponential growth potential. This vehicle serves a primary purpose of facilitating capital acquisition for promising entrepreneurs who may be limited by an inadequate or non-existent operational history. However, similar to all investments, it is not devoid of risks. The high-risk profile associated with venture capital investments is primarily a byproduct of the inherent uncertainty cloaking fledgling businesses.

Early-stage venture capital funding typically progresses through several stages including pre-seed, seed, Series A, and Series B rounds. Moreover, venture capital manifests in two distinct types: early-stage seed capital, fueling the initial steps of the startup, and expansion funding, which supports scale and growth. Acquiring a thorough understanding of these stages is integral to empowering both entrepreneurs and investors to navigate the labyrinthine landscape of venture capital investments with informed and strategic decisions.

For entrepreneurs and investors alike, awareness of the various stages of venture capital, along with the associated risks, is crucial. This knowledge enables a refined assessment of a startup’s potential, thereby informing investment decisions or fundraising strategies. To facilitate this understanding, we’ll delve into each funding stage in detail, providing a comprehensive overview of the venture capital investment process.

Seed Stage: Planting the Seeds for Growth

The seed stage marks a pivotal milestone in the venture capital investment trajectory, where startups devote their efforts towards crafting compelling pitch presentations, securing initial capital, and engaging with venture capitalists to showcase their potential for growth and proliferation. At this stage, venture firms provide funding to facilitate the entrepreneur’s journey from a mere concept to a fledgling product. It’s a phase that generally finances the research and development of innovative products and services, along with critical market research. This is difficult when it comes to raising money. I have spoken with many entrepreneurs and the “hit rate” on raising money tends to only be around 1% to 4%.

The primary objective of procuring capital during the seed stage is to convincingly demonstrate to prospective investors that the business harbors the potential to scale and evolve. Nevertheless, the seed stage could demand the most expensive cost in terms of equity stake that the company might need to surrender to secure the investment. This stage is often viewed as a double-edged sword, offering both opportunity for growth and risks associated with high stakes.

Successfully steering through the seed stage enables startups to validate their growth and scalability potential, thereby drawing the attention of venture capitalists and other investors. This phase is instrumental in sowing the seeds for prospective triumph and laying the groundwork for ensuing funding rounds.

In the broader context of a startup’s journey, the seed stage serves as a litmus test for the viability of the business concept. Here, entrepreneurs must effectively utilize their initial capital to validate their business models, refine their products or services, and establish a solid market presence. This not only tests their resilience and strategic acuity but also sets the tone for the company’s future trajectory. Thus, effective navigation of the seed stage is a significant determinant of the startup’s long-term success.

Series A Stage: Cultivating the Product-Market Symbiosis

As the initial round of venture capital financing, the Series A stage marks a critical juncture where startups concentrate on attaining product-market fit, enhancing their offerings, expanding their client base, and showcasing consistent revenue streams. During this phase, investors meticulously evaluate the startup’s data and projected valuation to discern whether it constitutes a sound investment opportunity.

In the context of a startup’s trajectory, the Series A stage can be viewed as a period of rigorous validation. It’s the phase where the theoretical meets the practical: a startup’s lofty ideals must prove their mettle in the crucible of the market. More than merely surviving, startups must illustrate a pattern of strategic growth and expansion that lends itself to scalability. This involves demonstrating clear KPIs, robust business models, and a keen understanding of customer needs and market dynamics.

Furthermore, entrepreneurs should also be cognizant of the fact that Series A financing isn’t just about securing funds; it’s about forging strategic partnerships. The investors brought onboard during this round can often provide invaluable guidance, connections, and resources, significantly impacting the startup’s growth trajectory. Therefore, in choosing investors, startups must also consider the long-term strategic value they bring to the table. This comprehensive approach ensures not only the survival but also the growth and success of the enterprise in an increasingly competitive marketplace.

Series B Stage: Amplifying Operations and Market Presence

Series B funding represents an integral segment of early-stage venture capital, typically accessed by mature startups poised for significant market expansion and in need of supplementary funding. This phase often involves raising capital to penetrate new markets and assemble operational teams. The financial scope of Series B funding rounds typically oscillates between $7 million and $10 million.

The quantum of funding a company can secure during a Series B round hinges on a variety of factors, including industry norms, the company’s valuation, and more. Venture capital firms emerge as the predominant players in the Series B funding landscape, with angel investors ranking as the second most common source, beyond traditional venture capital entities.

Successfully traversing the Series B stage necessitates that startups exhibit their capacity to attract additional investors for the purpose of amplifying operations and broadening their market footprint. By substantiating their growth potential, startups can lure more funding from venture capital firms and angel investors, thus catalyzing their journey towards further success.

Expanding on this, the Series B stage is not merely about garnering additional funds but also about strategic growth and positioning. At this stage, startups must employ the lessons learned from their early operations to perfect their business model, enhance product offerings, and streamline operations. They must demonstrate a proven track record of success, backed by consistent growth metrics, to inspire confidence among prospective investors.

Moreover, the Series B stage often sets the tone for future rounds of funding. A successful Series B round can significantly enhance a startup’s credibility, making it easier to attract more substantial investments in the future. Hence, it’s not just about weathering the current financial landscape but also about paving the way for a prosperous and sustainable future for the business. This strategic foresight coupled with operational excellence can help startups successfully navigate this pivotal stage of venture capital financing.

Expansion Stage: Series C and Beyond – Amplifying Growth and Success

The Expansion Stage, often referred to as Series C and subsequent rounds, is typically reached when a company has already demonstrated considerable success and boasts a strong customer base, stable revenue stream, and an impressive trajectory of growth. It’s a phase when investors, potentially hedge funds, investment banks, or private equity firms, express heightened interest in investment opportunities.

In order to qualify for Series C funding, businesses must exhibit a robust customer base, consistent revenue generation, a documented history of growth, and a robust ambition to spread their wings on an international scale.

This stage frequently entails raising substantial funds to facilitate significant business events such as mergers and acquisitions, and to kindle further expansion. Successfully maneuvering through the Expansion Stage demands a proven track record of success coupled with a crystal-clear growth strategy.

By effectively illustrating their capacity to scale their operations and retain a dedicated customer base, startups can pique the interest of premier investors, thus securing the necessary funding to propel their enterprise to new summits of success.

Moreover, the Expansion Stage also represents a pivotal moment for startups to consider strategic partnerships and alliances, thereby enhancing their market presence and competitive advantage. The larger scale and higher stakes during this stage offer both challenges and opportunities. Startups must be prepared not only to tackle these challenges head-on but also to seize these opportunities to fuel their growth and solidify their standing in the market.

Therefore, as they navigate the Expansion Stage, startups should strive for operational excellence and strategic foresight. This dual focus will ensure they can sustain their growth, leverage opportunities, and forge a prosperous path for their future in the ever-evolving and competitive business landscape.

Mezzanine Stage: Paving the Way for Liquidity Events

The Mezzanine Stage signifies a pivotal transition in a company’s lifecycle, marking its progression towards liquidity events such as an Initial Public Offering (IPO) or a strategic acquisition. By the time a company reaches this stage, it is considered a mature and viable entity, seeking funding to bolster notable business events. This phase indicates that the company has achieved a level of stability and has proven its ability to compete efficaciously within the market.

During the Mezzanine Stage, companies engage in critical negotiations on the loan amount, interest rates, and terms of agreement with prospective lenders. This process also entails preparing and organizing all the relevant legal documentation. Investors at this stage typically anticipate a return on their investment, either through an IPO, wherein the company offers its shares to the public, or through the sale of the company to a larger entity.

Successfully traversing the Mezzanine Stage demands a laser-focused approach on preparing the company for a liquidity event and securing the necessary funding to facilitate this transition. This transition is not just about garnering capital; it’s about showcasing the company’s maturity and viability.

By conveying their operational maturity and viability as a business, companies can pique the interest of prospective investors and private equity funds. This not only puts them in a favorable position for securing investment but also sets them on the path for long-term success. In essence, the Mezzanine Stage serves as the bridge connecting a startup’s growth journey with its ultimate goal of liquidity, marking a key milestone in its trajectory towards success.

Initial Public Offering (IPO): Going Public

Going public, or an Initial Public Offering (IPO), is the process of a private company offering its shares to the public for the first time. This significant event can generate substantial funds for businesses, facilitating mergers and acquisitions raise capital again, and offering executive remuneration.

The IPO process also involves a lock-up period, a predetermined timeframe that follows the initial offering, during which insiders, such as venture capitalists, are barred from selling their shares to protect the stock price. Successfully navigating the IPO process requires careful planning and execution, as well as a focus on maintaining stock price stability.

By going public through an IPO, companies can raise significant capital, expand their market reach, and reward their early investors. This milestone event marks the culmination of a successful venture capital journey and the beginning of a new chapter in a company’s growth story.

Alternative Funding Options

Besides venture capital, there are alternative funding options available for startups and businesses seeking financial support. There are multiple ways to fund a business raise venture capital. These options include self-funding, small business loans, angel investments, and venture capital. Each one has its own associated pros and cons.

Self-funding may be sourced from personal savings and credit cards, while small business loans are typically provided by banks and other financial institutions. Angel investors are high-net-worth individuals who provide substantial capital to business ventures, often without requiring repayment in the event of business failure.

Understanding the different funding options available can help entrepreneurs and investors make more informed decisions about which route is best suited to their needs. By exploring alternative funding options, businesses can secure the financial support they need to grow and thrive, even in the absence of venture capital investment.

Key Factors for Success in Venture Capital Investment

Achieving success in venture capital investment necessitates several key factors, including a well-structured management team, a good standing, a concentration on a specific area of expertise, and the capacity to take calculated risks. Additionally, due diligence and an in-depth comprehension of market trends are essential.

Having a functional prototype or minimum viable product (MVP) is crucial, as it illustrates the potential of the product or service and provides investors with a tangible illustration of the business’ prospects. Stable operations, a clear business model, and accurate analysis of business operations, revenue, sales, market size, growth rate, potential risks, and startup valuation are also critical factors for success in venture capital investment.

By focusing on these key factors, both entrepreneurs and investors can maximize their chances of success in the competitive world of venture capital investment. With a solid foundation, a clear vision, and a strong understanding of the market, startups can achieve their full potential and transform their ideas into thriving businesses.

Summary

In summary, mastering the stages of venture capital investment is integral for entrepreneurs and investors alike, as they steer their way through the intricate world of startup financing. From the inception at the pre-seed stage through to the mature mezzanine stage, each juncture in the venture capital journey serves as a significant landmark in a startup’s trajectory, shaping its growth and ultimate success.

By astutely assessing the determinants of success in venture capital investment, entrepreneurs enhance their prospects of securing much-needed funding, while investors gain a stronger footing to make informed decisions on resource allocation. In essence, the venture capital landscape, while high-risk, offers high-reward potential, with the capacity to revolutionize industries, generate employment opportunities, and fuel innovation.

As you chart your course in the vibrant world of venture capital investment, bear in mind the critical steps involved: establishing a robust foundation, fostering a strong product-market fit, scaling operations strategically, and demonstrating consistent, exponential growth. Armed with determination, resilience, and a profound understanding of the venture capital stages, you stand poised to elevate your startup’s success to unprecedented heights.

Frequently Asked Questions

What are the five stages of venture capital funding?

Venture capital funding is a multi-stage process that typically involves the pre-seed, seed, early stage, expansion, and late stage of development. Each vc funding stage provides support and capital for different aspects of growth and innovation.

Therefore, venture capital is an essential tool for helping businesses realize their potential.

How many stages are there in venture capital?

Venture capital has five distinct stages – pre-seed funding, startup capital, early stage, expansion, and later stage. Each of these stages requires unique considerations and should be evaluated carefully to ensure the best outcome for any venture capital firm.

By gaining a better understanding of each stage, investors can maximize their return on investment.

What is the life cycle of a venture capital fund?

The life cycle of a venture capital fund is a systematic process designed to create returns for investors. Funds are typically structured with a 2-3 year initial investment in period, 5 year deployment period, and a 10 year return capital period. This provides investors with an efficient system for investment and asset management.

What is the growth stage of venture capital?

At the growth stage of venture capital, a company has reached product-market fit, which allows for greater market penetration and scaleability.

Business-model fit then needs to be achieved, with a focus on creating a successful business model that is both repeatable and profitable.