Navigating the landscape of Initial Public Offerings (IPOs) can be daunting for many late-stage private companies. A frequent inquiry we receive from such companies, especially those gearing up for an IPO within the next 12-24 months, revolves around “pre-IPO converts.” This comprehensive guide will unpack the intricacies of pre-IPO converts and shed light on its various aspects.

1. Defining Pre-IPO Converts

A pre-IPO convert is a specialized debt instrument rolled out by a private company, predominantly in the final financing phase preceding an IPO. Unlike the standard debt securities found in public companies, pre-IPO converts manifest themselves in diverse, negotiable structures, rendering them more intricate than your regular equity financing or convertible note bridge round.

Its distinctiveness lies in its convertibility feature. Depending on stipulated conditions, like a few years post issuance or meeting set IPO standards, this debt can either be optionally or mandatorily converted into shares or cash, based on the prevailing stock price during conversion.

However, until this conversion takes place, it functions just like any other debt instrument. A handful of pre-IPO converts allow redemption by the issuing company, albeit typically at a significant premium. Notably, factors like cash interest, conversion price resets, board seats, and collateral are more prevalent in pre-IPO converts.

2. The Investor Perspective

Owing to the evolving investment landscape, various investors are now dabbling in private capital raises. Mutual funds, hedge funds, and even family offices, traditionally known for public market investments, are venturing into pre-IPO financing.

Many of these investors, seasoned in dealing with multifaceted financial instruments, afford companies added leeway in raising funds through diverse structures. However, traditional venture capitalists and numerous public investors often remain circumspect regarding these complex instruments.

3. Investor Benefits and Drawbacks

Convertible debts like pre-IPO converts are coveted by investors, merging the safety net of debt instruments with the allure of potentially lucrative stock conversions. However, the primary risk remains the stagnancy of stock prices, in which case, the investor’s yield diminishes.

Flexibility is a hallmark of pre-IPO converts, allowing investors to hash out structural aspects crucial to their interests. Some prioritize reducing risks, while others may pursue strategic investments or long-standing business ties with the issuer.

4. Company Perspective: Advantages and Limitations

For late-stage private companies, pre-IPO converts emerge as a viable financing route. They’re cost-effective compared to non-convertible debts and present promising future valuations. However, there are downsides, notably stock dilution upon conversion and potential hindrance in IPO demand. It’s imperative for companies to meticulously plan their M&A strategy and operations when contemplating a pre-IPO convert.

5. Suitability for Companies

It’s paramount for companies to demonstrate a credible trajectory towards an IPO within 12-24 months. Given the primary nature of the convert as a debt instrument, delays in the IPO can escalate costs. Companies fitting the “Unicorn” status, typically raking in over $100 million annually, are prime candidates for such instruments.

6. Critical Aspects in Negotiating a Pre-IPO Convert

Companies should consider a plethora of factors, including:

– Potential ineligibility of investors due to received projections.

– Acceptance of investor put options.

– Redemption options to advocate for.

– Repercussions of non-conversion on SEC disclosures.

– Electronic tradability of the pre-IPO converts.

7. Public vs. Pre-IPO Convert Comparison

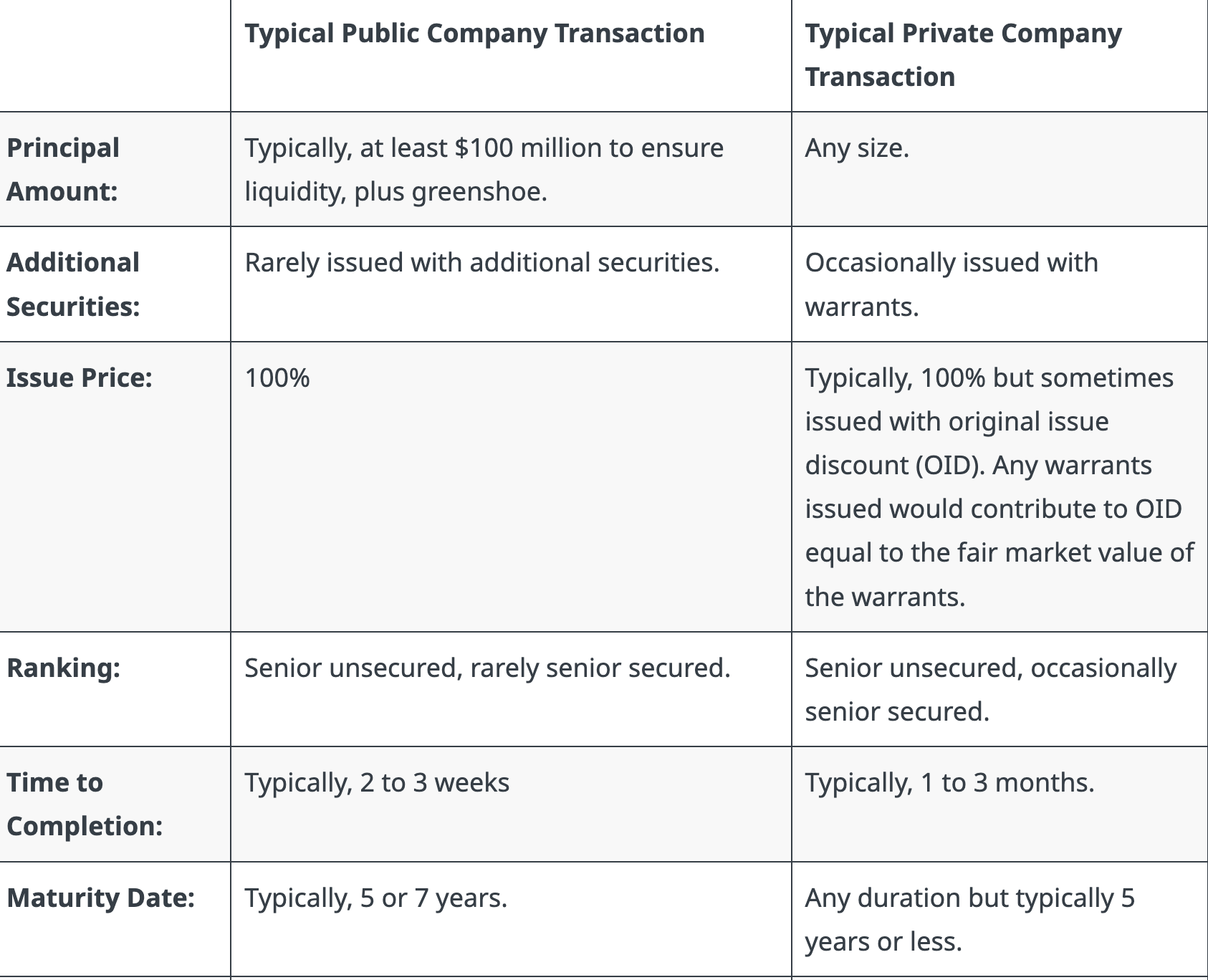

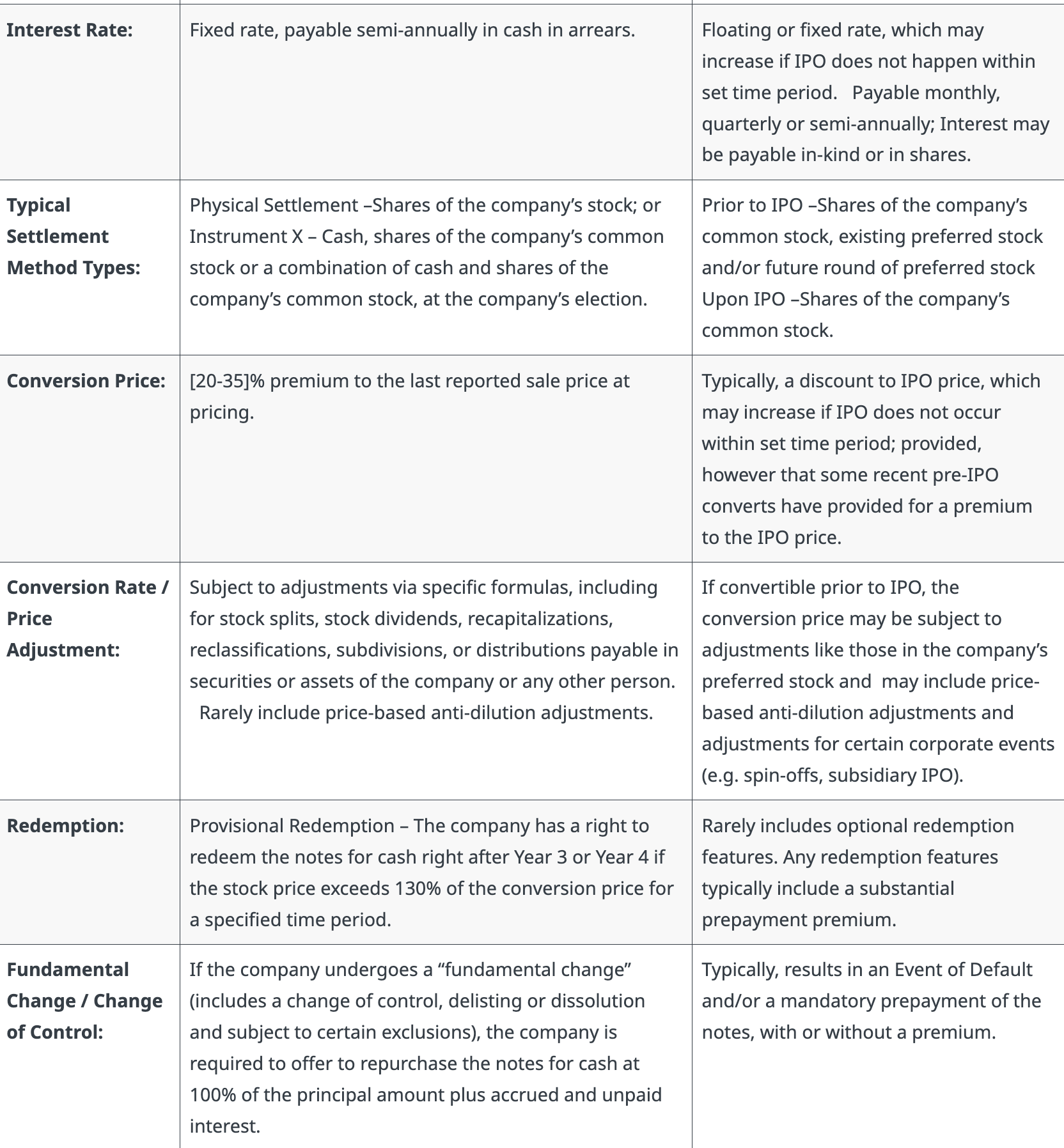

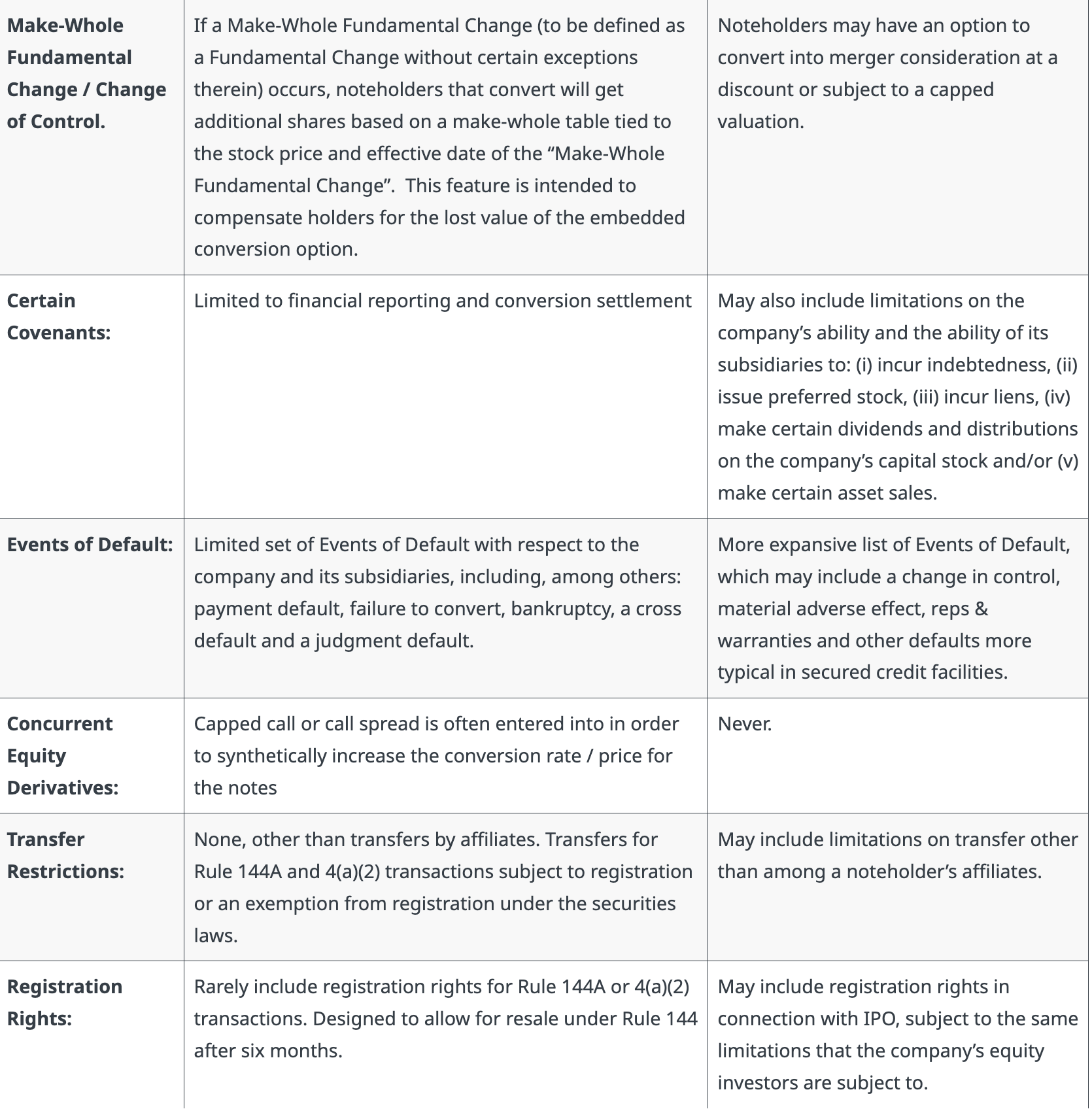

When diving deeper into the world of pre-IPO converts, it’s essential to distinguish them from their public counterparts. Here’s a comparative breakdown:

- Nature and Complexity: Public converts are generally standardized, with transparent structures. In contrast, pre-IPO converts boast a wide array of negotiable terms, making them inherently more complex.

- Liquidity: Public converts are often readily tradable, with market dynamics dictating their pricing. Pre-IPO converts, being private instruments, don’t offer the same liquidity, with pricing more dependent on individual negotiations between the investor and the company.

- Investor Base: While public converts attract a broad array of institutional investors familiar with public markets, pre-IPO converts are favored by a more niche group, including crossover investors, hedge funds, and family offices.

- Conversion Mechanisms: The conversion features in public company convertibles are standardized. However, in pre-IPO converts, the terms of conversion, especially the triggers for conversion and the conversion price, can be extensively negotiated.

8. Implementation Strategy for Companies

For companies considering a pre-IPO convert, there are some critical steps:

- Due Diligence: Ensure your company’s growth trajectory and fundamentals align with the expectations set by a pre-IPO convert. This involves rigorous internal financial audits and forward-looking projections.

- Engage Experts: Given the complexity, it’s advisable to collaborate with financial consultants, legal advisors, and investment bankers familiar with pre-IPO financing structures.

- Stakeholder Communication: Transparent communication with existing stakeholders, especially equity holders, is crucial, as they might be concerned about potential dilution.

- Negotiation Preparedness: Be ready with a list of non-negotiables and areas where you can exhibit flexibility. This will streamline the negotiation phase.

9. Final Thoughts

Pre-IPO converts offer an innovative financing mechanism for late-stage private companies eyeing the public markets. They bridge the gap between traditional equity financing and public debt instruments. However, their complexity demands meticulous planning, expert consultation, and robust negotiation skills.

Companies contemplating this route should weigh the immediate financial benefits against potential long-term implications. The journey of transitioning from a private entity to a publicly-traded one is rife with challenges, and the financing instruments chosen can significantly impact the transition’s smoothness and success.

Chart

The below chart may be useful in connection with Pre-IPO converts.

In essence, understanding and efficiently navigating the nuances of pre-IPO converts can significantly bolster a company’s prospects as it marches towards an IPO. Both investors and companies need to weigh the pros and cons, ensure compatibility, and approach negotiations with clarity and foresight.