Everything you need to know about a crypto tax audit to stay ahead in the new year.

If you use social media or even just own a phone, chances are you’ve heard about cryptocurrency. Bitcoin is mentioned a staggering every six seconds on social media, and the year 2022 is soon to end with over 300 million users/owners of crypto.1

On the off-chance that you’re just not that into technology and have avoided any exposure to the digital asset craze, you may have still become witness to the industry’s impact (and may have been a bit confused) if you file your taxes.

First introduced on Schedule 1 of Form 1040 in 2019, the International Revenue Service (”IRS”) moved the virtual currency question front and center on the Form in 2020.2 Following your personal information, the first page of the Form reads, “at any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

In those first two years, the IRS sent out over 10,000 warning letters to taxpayers who failed to report or misreported their crypto-related income, making it clear that they’re not playing games.

So how do you avoid a crypto tax audit? How should you prepare?

This article will walk you through everything you need to know to survive a crypto tax audit in 5 steps.

Step 1: Understand the Basics

The Crypto Tax Audit

If you are making a good-faith effort to report your crypto taxes accurately, likely, you will never face a crypto tax audit. However, just like traditional IRS audits, you may fall victim to random selection through the IRS’s statistical formula.3

The IRS may have reason to believe you have been misreporting your crypto-related income, or you may have been involved with another party who is being audited for that reason.

Regardless of why it may happen, to avoid a crypto tax audit you must be confident in what you need to report and how by first knowing the basic laws surrounding cryptocurrency taxes.

Crypto Tax Laws

In 2014, the IRS issued Notice 2014-21, 2014-16 IRB 938, announcing that virtual currency is treated as property for Federal Income Tax Purposes.

The following section answers some important crypto tax questions to build a working knowledge of the basics. For further guidance, visit TurboTax or the IRS Virtual Currency FAQ.

Filing Crypto Taxes

Any transaction that results in you earning or disposing of cryptocurrency is classified as a taxable event and requires reporting.

Disposing of cryptocurrency will result in capital gains or losses. Disposal includes4:

- Selling your cryptocurrency

- Trading crypto for another crypto

- Using your crypto to make a purchase

Earning crypto makes you subject to income tax. Earning transactions include5:

- Mining rewards

- Staking rewards

- Referral Rewards

- Airdrop Rewards

Tax-Free Crypto Transactions

How is crypto taxed?

Buying, selling, or exchanging crypto in a non-retirement account faces short-term or long-term capital gains or losses:

- Owning crypto for one year or less before any sale or spending is considered short-term capital gains. These are taxed at your standard income rate ranging from 10%-37% in the 2022 tax year.

- For cryptocurrency held for more than one year, profits are typically considered long-term capital gains and subject to the respective long-term capital gains tax rates of 0%, 15%, or 20% for the 2022 tax year.

The following tables are provided by TurboTax6:

2022 Short-Term Capital Gains Tax Rates

| Tax Rate | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

|---|---|---|---|---|---|---|---|

| Filing Status | Taxable Income | ||||||

| Single | Up to $10,275 | $10,276 to $41,775 | $41,776 to $89,075 | $89,076 to $170,050 | $170,051 to $215,950 | $215,951 to $539,900 | Over $539,900 |

| Head of household | Up to $14,650 | $14,651 to $55,900 | $55,901 to $89,050 | $89,051 to $170,050 | $170,051 to $215,950 | $215,951 to $539,900 | Over $539,900 |

| Married filing jointly | Up to $20,550 | $20,551 to $83,550 | $83,551 to $178,150 | $178,151 to $340,100 | $340,101 to $431,900 | $431,901 to $647,850 | Over $647,850 |

| Married filing separately | Up to $10,275 | $10,276 to $41,775 | $41,776 to $89,075 | $89,076 to $170,050 | $170,051 to $215,950 | $215,951 to $323,925 | Over $323,925 |

2022 Long-Term Capital Gains Tax Rates

| Tax Rate | 0% | 15% | 20% |

|---|---|---|---|

| Filing Status | Taxable Income | ||

| Single | Up to $41,675 | $41,676 to $459,750 | Over $459,750 |

| Head of household | Up to $55,800 | $55,801 to $488,500 | Over $488,500 |

| Married filing jointly | Up to $83,350 | $83,351 to $517,200 | Over $517,200 |

| Married filing separately | Up to $41,675 | $41,676 to $258,600 | Over $258,600 |

Calculating crypto capital gains and losses

💡 Capital gain or loss = proceeds – cost basis

To accurately calculate and report your crypto transactions, keep a record of each transaction and the tokens purchased or earned in each transaction.

This record is called a “tax lot.”7 Your tax lot should include the following:

- The amount and respective currency of the involved digital asset

- The date of acquisition and the fiat value at that time

- The date of sale and the fiat value at that time

Your cost basis is the original value of the asset for tax purposes. There are two critical variables that can affect your cost basis: i) accounting method and ii) transaction fees.

Accounting Method: taxpayers may choose their specific ID accounting method; different methods will match sales and acquisitions differently, resulting in other cost bases.

Transaction Fees: Depending on the type of transaction, related transaction fees or Ethereum gas fees can be added to your cost basis, impacting your capital gains or losses.

Once you have a detailed record of your transaction history, you can calculate your capital gains and losses.

If you don’t want to do this by hand, you can use a crypto tax calculator to simplify the process. Using this method, you import your exchange trade history and off-exchange transactions, and the calculator calculates your crypto taxes. Be sure that the data is calculated correctly.

Next, you will decide on an accounting method, export your crypto tax forms, and include those taxes on your return.

How to Report

To avoid a crypto tax audit, you should report your capital gains and losses on IRS Form 8949. Included in your report will be i) a description of the “property” or asset you sold, ii) the date of original acquisition and date of disposal, iii) earnings from the sale, iv) your cost basis, and v) your gain or loss.8

Upon completing your 8949, you take your total net gain or loss and report it on IRS Form 1040 Schedule D.

Cryptocurrency income earned from mining, staking, referral bonuses, or work is reported on either Schedule 1, Schedule B, or Schedule C.

For earnings from airdrops, forks, crypto wages, or hobby income, use Schedule 1, line z: other income.

Staking income or interest rewards from lending gets reported on Schedule B.

Crypto income earned while acting as a business entity, like performing a job or running a crypto mining job, is generally treated as self-employment income and reported on Schedule C.

Step 2: Stay Prepared

What Triggers An IRS Crypto Tax Audit

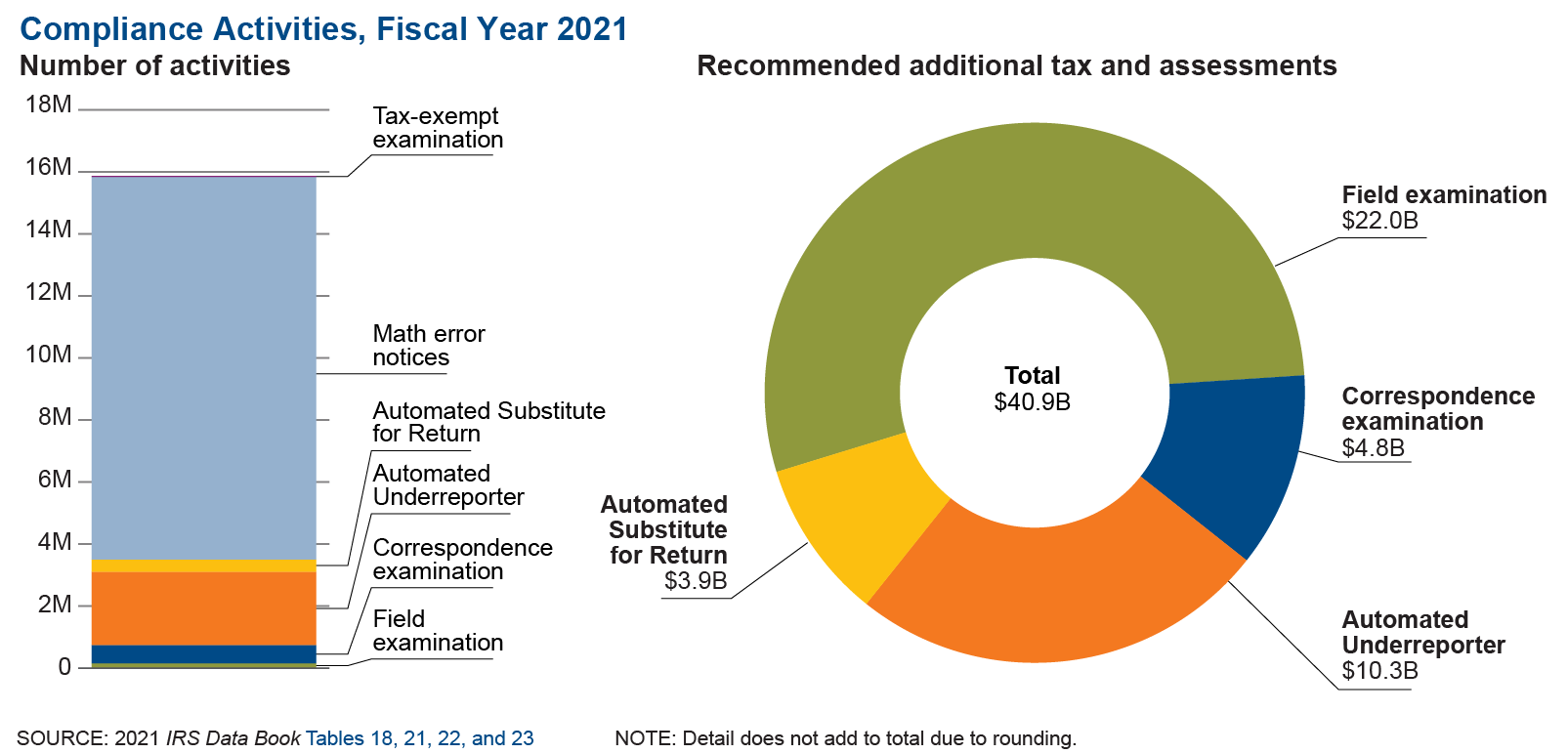

Last year, the IRS audited 738,959 tax returns, which resulted in nearly $27 billion in recommended additional tax. While those numbers seem large, less than one percent of personal tax returns are audited yearly.

IRS Compliance Activity Data for 2021 – IRS

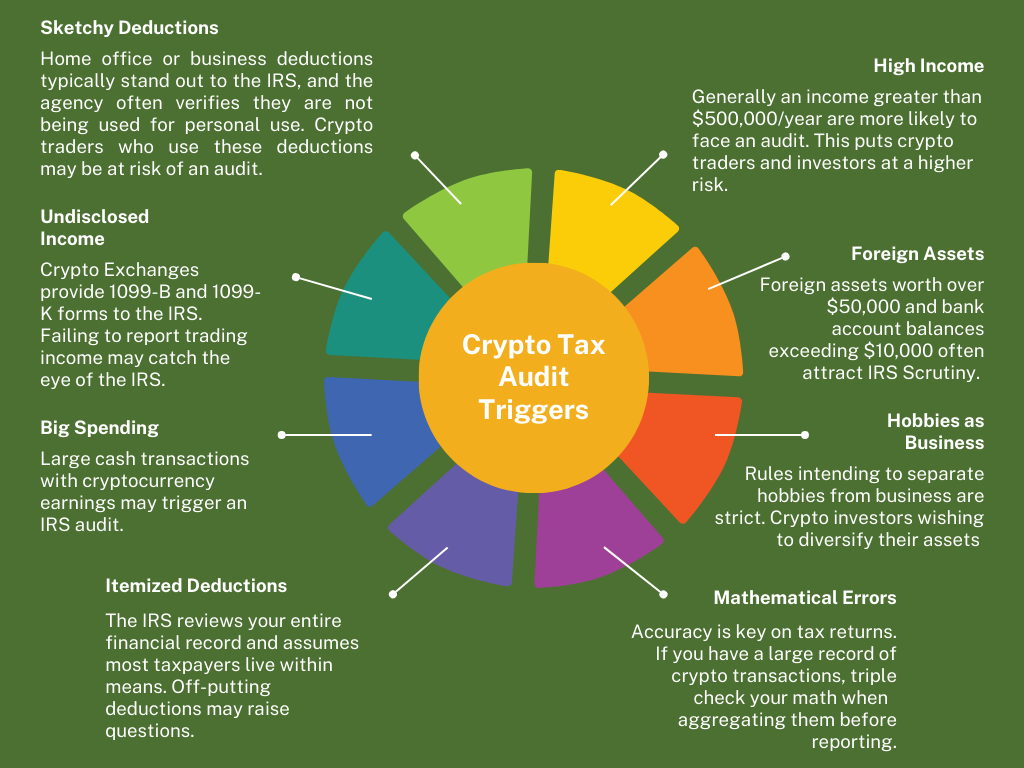

It’s impossible to predict an IRS audit, but we’ve compiled a list of high risk triggers that could lead to a crypto tax audit.

How to Prepare for a Crypto Tax Audit

The buy and sell price of each transaction will be at the forefront of an IRS examination, but that’s not all it will take to satisfy an IRS audit.

In addition to the tax lot we mentioned above, keeping accurate and detailed records of all crypto-related transactions made in the respective tax year is crucial to stay prepared for a potential crypto tax audit.

If a transaction involves an exchange, blockchain, or broker, all records will be documented by the associated parties, but it’s important to keep your own. If you paid electronically, you should keep a record of your EFTs and wire transfers as well.9

Keep a personal log of any blockchain addresses you own or control, your account numbers, keys, IP addresses, and banks linked to your user IDs.

Keep your records for a minimum of five years, but it doesn’t hurt to hang on to them for longer, just in case.

In addition, remember everything you post online is public. Don’t post anything that would help build a case against you or unintentionally draw the eye of the IRS.

The documentation outlined above is the most commonly requested by the IRS during a crypto tax audit.

Step 3: Surviving the Audit

What to Expect

An IRS audit may not be limited to your financial records. They may ask further questions, dig for details, and even seek information from outside sources. Be prepared to honestly lay out all of your crypto history.

The duration of your crypto tax audit depends on the extent of your crypto history and the complexity of each transaction. Once your documents have been thoroughly reviewed, they may follow up with questions regarding any discrepancies.

Upon completion, you’ll receive a letter explaining their findings and any amount they have determined you owe in taxes, and you will have 30 days to appeal if you feel necessary.

However, if the results of the audit determine tax evasion or fraud, your case could instead be passed along to the Department of Justice.

Crypto IRS Letters

Over the last few years, the IRS has sent warning letters to taxpayers who potentially face a crypto tax audit.

IRS letters 6174, 6174-A, and 6173 range in seriousness, but it is important to note that they do not necessarily mean you are in danger with the IRS. Also, the absence of a warning letter does not imply you are safe from a crypto tax audit.10

This letter means the IRS is aware of cryptocurrency accounts belonging to you. It provides the crypto taxation policies and urges you to file if you haven’t or correct any errors in those you have.

If the IRS has suspicions that you may have failed to report or misreported crypto income but isn’t sure, they may send you this letter.

Letter 6174-A provides explicit instructions on proper filing and reporting and asks you to immediately correct any missteps in your filed return.

This is the most serious of the three. Receiving Letter 6173 means the IRS assumes you’ve failed to report your crypto income or haven’t filed returns for one or more years between 2013-2017.

You may have skipped a form or schedule required by your crypto taxes if you have.

You have 30 days to respond or request an extension.

Step 4: Avoid Future Audits

How to Avoid a Crypto Tax Audit

While there are no steps to take that will assure you are not at risk of a crypto tax audit, you can minimize your chances by responsibly handling your crypto taxes.

Accurate Reporting and Filing

Be sure to always file your crypto taxes, following the guidelines explained in this article and in accordance with the IRS website.

Always include the accounting method used to calculate your capital gains.

Include any additional information deemed appropriate that is not represented in the data.

Explain the Trigger Factors Present

Providing detailed explanations for events that may be considered a crypto tax audit trigger, such as steep rise or fall in income, suspicious deductions, or foreign assets.

Don’t Over-Report Deductions

While running a crypto business allows you to deduct related expenses, be sure to live within your means and not claim inappropriately large deductions in proportion to your income.

Double Check, Triple Check

The IRS has an eye for inaccuracy. Make sure to check any calculations and all data for accuracy before filing to avoid a crypto tax audit.

Step 5: Learn the FAQs

1. Can you get audited for cryptocurrency?

Yes! You are susceptible to a crypto tax audit if your crypto transactions involve a taxable event.

2 How long does a crypto tax audit take?

The audit duration depends on the extent of your crypto transactional history and the complexity of each transaction.

3. Which crypto exchanges do not report to the IRS?

All major cryptocurrency exchanges must report to the IRS to operate legally in the US.

4. How far back does a crypto tax audit go?

Audits include all tax returns filed in the previous three years. If they notice an additional error, they may go back further. However, if a return is missing or deemed fraudulent, they may go back as far as they feel necessary. The maximum length is three years.

5. Can the IRS still find my transactions if I don’t report them?

Anytime you receive a 1099, the IRS receives an identical copy. Accordingly, any transactions recorded on a blockchain are public and permanent. Failure to report may lead to a crypto tax audit, interest, or possible criminal charges.

While some transactions are anonymous, the IRS has ways to link wallets to specific individuals.

All crypto exchanges report to the IRS, so your exchange records will be identifiable even if you fail to report them.

6. What if I forgot to report my crypto taxes?

Don’t stress! You can always amend a previous year’s tax return using IRS Form 1040X.

7. How is lost and stolen cryptocurrency taxed?

While you are still required to report lost or stolen cryptocurrency, they are no longer tax-deductible following the Tax Cuts and Jobs Act of 2017. These events include:

- Lost coins due to exchange hacks

- Lost coins due to wallet hacks

- Lost coins from sending crypto to the wrong address

- Other negligent forms of loss

8. Can the IRS seize Bitcoins?

Yes. The IRS can seize any crypto assets to settle unpaid taxes.

9. What happens if I don’t file?

You may face additional taxes, interest, significant penalties, or even criminal charges if you fail to report your crypto-related taxable events.

10. Should I reach out to an accountant?

If you’re facing a crypto tax audit or aren’t sure you can accurately navigate crypto taxes, it is best to speak to a tax professional. It is also vital that you choose an accountant with crypto experience.

You can also contact a specialized cryptocurrency lawyer for advice if you need legal assistance.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Securities law is complex and highly fact specific to any given circumstance and readers should contact an attorney for advice regarding any type of legal matter.

1Jordan Tuwiner, 63+ Cryptocurrency Statistics, Facts & Trends, Buy Bitcoin Worldwide (July 15, 2022), https://buybitcoinworldwide.com/cryptocurrency-statistics/.

2Amber Gray-Fenner, IRS Adds New Guidance But Form 1040 Cryptocurrency Question Is Still Causing Confusion, Forbes (March 5, 2021, 8:57 AM), https://www.forbes.com/sites/ambergray-fenner/2021/03/05/irs-adds-new-guidance-but-form-1040-cryptocurrency-question-is-still-causing-confusion/?sh=bf56e95699a2.

3Zac Mcclure, What to Expect from a Crypto Tax Audit, TokenTax (last updated Sep. 8, 2022), https://tokentax.co/blog/what-to-expect-from-an-irs-crypto-audit.

4Miles Brooks, The Ultimate Crypto Tax Guide (2022), CoinLedger, https://coinledger.io/crypto-taxes#crypto-taxes-101.

5Id.

6Riley Adams, Your Crypto Tax Guide, TurboTax (last updated Dec. 15, 2022, 4:41 PM), https://turbotax.intuit.com/tax-tips/investments-and-taxes/your-cryptocurrency-tax-guide/L4k3xiFjB.

7Zac Mcclure, How to Calculate Crypto Gains Step-by-Step, TokenTax (last updated Sep. 30, 2022), https://tokentax.co/blog/how-to-calculate-your-crypto-taxes#4.-calculating-your-crypto-gains.

8Miles Brooks, How to Report Cryptocurrency On Your Taxes in 5 Steps, CoinLedger, https://coinledger.io/blog/how-to-report-cryptocurrency-on-taxes.

9How to avoid a crypto tax audit, ZenLedger (April 22, 2022), https://www.zenledger.io/blog/how-to-avoid-a-crypto-tax-audit.

10Received IRS Letter 6173 or 6174? Here’s What To Do, Koinly Blog, https://koinly.io/blog/received-crypto-tax-letter-6173-irs/.