If you’re exploring financing options for your startup or early-stage company, you may have come across the term “convertible promissory note.” But what exactly is a convertible promissory note, and how does it work? In this article, we’ll provide you with an overview of this financing instrument, explaining its key elements, why it’s popular, and its benefits and disadvantages.

Before we dive into the specifics of a convertible promissory note, let’s separate the two fundamental concepts of its title.

A promissory note is a legal document representing a promise to repay a specified amount of money, typically with interest, within a predetermined period. The note outlines the terms and conditions of the loan, including the principal amount, interest rate, maturity date, and prepayment process.

Convertible debt, also known as convertible notes or convertible loans, is a form of financing that allows companies to raise capital by issuing debt instruments that can be converted into equity at a later stage.

So, what is a convertible promissory note? Simply put, it is a promissory note that includes a conversion feature.

What is a Convertible Promissory Note?

A convertible promissory note, or convertible note, is a type of debt instrument that combines elements of both debt and equity. It is a short-term debt that can be converted into equity at a later stage.

Startups often use convertible promissory notes to raise capital during their early growth stages or bridge financing between rounds of equity funding. These notes allow companies to secure funding while deferring the valuation of the company until a later date when there is more information and a more accurate assessment of its value.1

See our sample Florida Convertible Promissory Note here.

How Does Convertible Promissory Work?

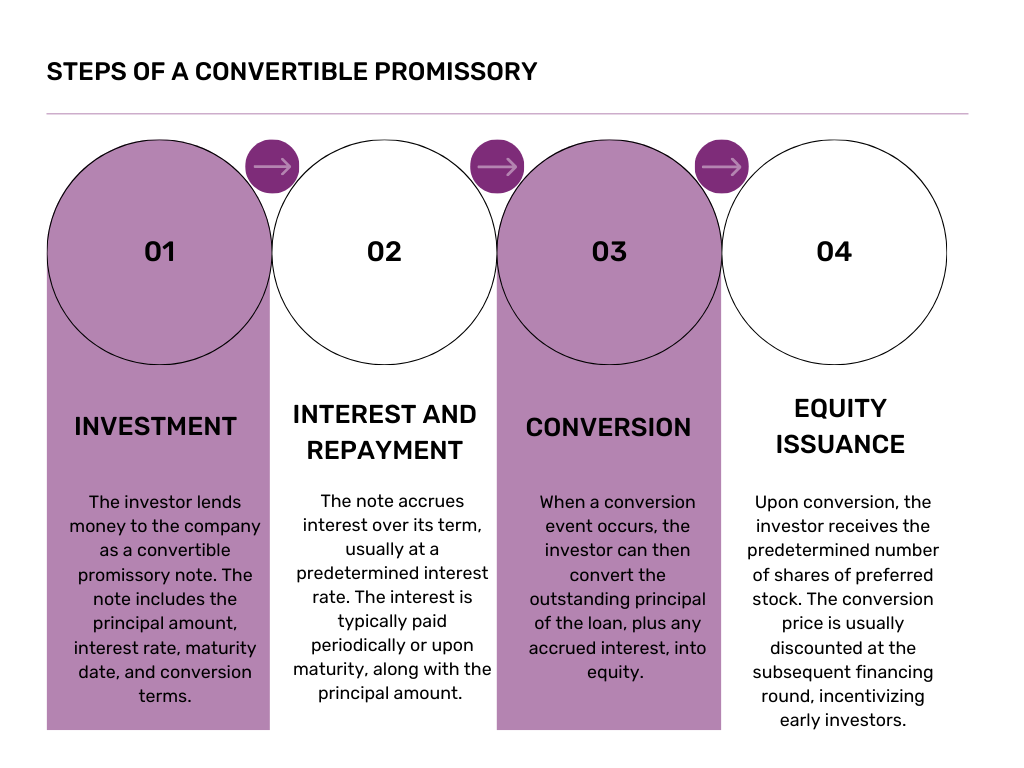

When a company issues a convertible promissory note, it borrows money from investors who become debtholders. The note outlines the terms of the loan, such as the interest rate, maturity date, and conversion terms.

At a predetermined event, typically during a subsequent financing round or upon reaching certain milestones, the debtholder has the option to convert the debt into equity.2

The conversion is based on a predetermined conversion price or a formula tied to the valuation of the company at the time of conversion.

Typically, the conversion price is set at a discount to the price per share paid by new investors in subsequent financing rounds, incentivizing early investors to participate in the company’s growth.

Common Elements of a Convertible Promissory Note

To understand convertible promissory notes fully, it’s essential to grasp some key terms associated with them:

a. Discount Rate: The discount rate is a percentage applied to the valuation of the startup during the conversion, allowing noteholders to purchase equity at a lower price compared to future investors.3

b. Valuation Cap: The valuation cap sets an upper limit on the valuation at which the convertible note can convert into equity. It provides protection for investors, ensuring they receive a fair share of ownership, even if the company’s value skyrockets.

c. Interest Rate: Convertible notes may accrue interest over time, increasing the principal amount. The interest accrued can convert into additional shares upon conversion.

d. Maturity Date: The maturity date is the deadline for the repayment of the convertible note. It signifies the point at which the startup must repay the principal and any accrued interest.

e. Conversion Ratio: The conversion ratio determines the number of shares of equity that the convertible note can be converted into. The conversion ratio is typically expressed as a ratio or formula specifying the number of shares per dollar of the note’s principal.

f. Conversion Events: The convertible note will specify the events that trigger the conversion right. These events can include subsequent equity financing rounds, an initial public offering (IPO), or the company’s acquisition.

g. Prepayment: Refers to the ability of the issuer, in this case, the company, to repay the outstanding principal of the note before the specified maturity date. It allows the company to repay the investor’s loan obligation before the agreed-upon due date.4

Why are they used?

Convertible promissory notes are popular among startups and early-stage companies for several reasons5:

- Simplicity: They offer a simpler and faster fundraising process compared to equity financing, as there is no immediate need to negotiate a company valuation.

- Flexibility: They provide flexibility in determining the conversion terms, allowing for negotiation with individual investors and tailoring terms to their preferences.

- Delayed Valuation: Convertible notes delay the valuation negotiation until a later stage when there is more information and evidence of the company’s performance, reducing the risk of undervaluation.

When Should a Convertible Promissory Note Be Used?

Convertible promissory notes are most commonly used by companies in the early stages of startups. These notes are frequently used during seed or pre-seed funding rounds when the company may not have an established valuation or financial track record.6

This financing option is often also utilized as a bridge financing tool. If a company has completed an initial financing round but anticipates the need for additional funds before the next priced equity round, a convertible note can provide temporary financing. This allows the company to secure immediate capital while they continue negotiations and preparations for the next funding round.7

In cases where rapid funding is needed, convertible notes offer an efficient option. Compared to negotiating and executing a priced equity round, the issuance of these notes involves fewer legal and administrative complexities.

Convertible promissory notes can also be beneficial for companies with smaller financing needs. Conducting a small equity round might not be practical due to the associated costs and potential negative perception. Instead, they can use convertible notes to raise the necessary funds without the complexities and drawbacks of a small equity round.8

What Are the Advantages of a Convertible Promissory Note?

Convertible promissory notes offer several advantages for both investors and companies.

For investors, they provide the potential for high returns if the note converts into equity, allowing them to benefit from the company’s success. These notes also offer an early investment opportunity, allowing investors to get involved in the early stages of a company.9

Additionally, they provide debt protection, ensuring that investors have a higher priority in recovering their investment compared to equity holders if the company fails.

For companies, convertible promissory notes offer access to capital without an immediate valuation, allowing them to raise funds quickly. They also allow for a delayed valuation, which can be beneficial in later funding rounds. 10

These notes help preserve ownership and control for companies by minimizing immediate dilution. Furthermore, companies can often choose to pay interest on the notes in equity instead of cash, reducing cash flow strain.

Overall, convertible promissory notes provide flexibility and advantages for both investors and companies in financing arrangements.

What Are the Risks of a Convertible Promissory Note?

Investing

Firstly, there is no guarantee of a favorable return on investment if the note does not convert into equity or if the company’s valuation at the time of conversion is unfavorable. This uncertainty can make it challenging for investors to accurately assess the potential gains from their investment.11

Additionally, if the company fails to meet the conversion conditions or goes bankrupt, investors risk losing their entire investment in the form of principal and interest.

Lastly, convertible notes can dilute existing shareholders’ ownership stake if subsequent funding rounds or conversions occur at lower valuations, reducing the investor’s share of the company.12

Issuing

Converting convertible notes can complicate future financing rounds and decision-making processes, as there are more shareholders to consider.13 Additionally, companies must meet interest payment obligations, which can impact cash flow, especially if the interest must be paid in cash rather than equity.

Moreover, companies may face pressure to achieve the milestones necessary for conversion, which could divert resources and attention from their core operations.

Lastly, postponing the valuation of the company until a subsequent funding round creates uncertainty, impacting negotiations and investor perceptions.

Make Sure it Works for You

Deciding whether a convertible promissory note is suitable for a startup or an investor requires careful consideration of the specific circumstances and objectives.

Startups should assess their financing needs, long-term goals, and investor preferences. Investors should evaluate their risk appetite, desired returns, and confidence in the startup’s potential for success.

Remember, each startup’s circumstances are unique, so it’s always recommended to seek professional advice tailored to your specific situation.

Convertible promissory notes can be powerful tools in the startup financing toolkit, and understanding how they work is a significant step towards success.

Where Can I Find an Example?

As a resource for our community, we have prepared a sample Florida convertible promissory note for review. Designed to showcase the key features and structure of a convertible promissory note, this sample document provides a practical template for entrepreneurs and investors alike, offering a better understanding of the terms and conditions involved in this common financing instrument. Any personal information has been redacted for client confidentiality. You can find the example here.

1CFI Team, Convertible Note, Corporate Finance Institute (last updated June 28, 2023), https://corporatefinanceinstitute.com/resources/fixed-income/convertible-note/.

2Annalise F. Perry, An Introduction to Convertible Notes, Wyrickrobbins (Mar. 20, 2023), https://www.wyrick.com/news-insights/an-introduction-to-convertible-notes#:~:text=What is a convertible promissory,a sale of the company.

3What Is a Convertible Note? A Startup Funding Guide, Pulley (May 5, 2023), https://pulley.com/guides/what-is-a-convertible-note.

4Convertible Notes Overview, University of Pennsylvania, Law School, https://www.law.upenn.edu/clinic/entrepreneurship/startupkit/convertible-note.pdf.

5Ian Lee, et al., What is a Convertible Note? AngelList (last accessed June 24), https://learn.angellist.com/articles/convertible-note

6Supra note 2.

7Corey Mitchell, Bridge Financing Explained: Definition, Overview, and Example, Investopedia (last updated Oct. 28, 2020), https://www.investopedia.com/terms/b/bridgefinancing.asp.

8Supra note 2.

9Aaron Kellner, Pros and Cons of Convertible Notes, Seedinvest (Sep. 1, 2016), https://www.seedinvest.com/blog/angel-investing/pros-and-cons-of-convertible-notes#:~:text=Convertible note financings tend to,shares or issue common stock.

10What is a Convertible Note? EquityEffect (Sep. 1, 2021), https://www.equityeffect.com/blog/what-is-a-convertible-note/.

11Pros and Cons of Convertible Notes, Management Study Guide (last accessed June 20, 2023), https://www.managementstudyguide.com/convertible-notes-and-startup-funding.htm.

12Id.

13Supra note 9.