The Setup: Footnotes, Frustration, and a Familiar Fight

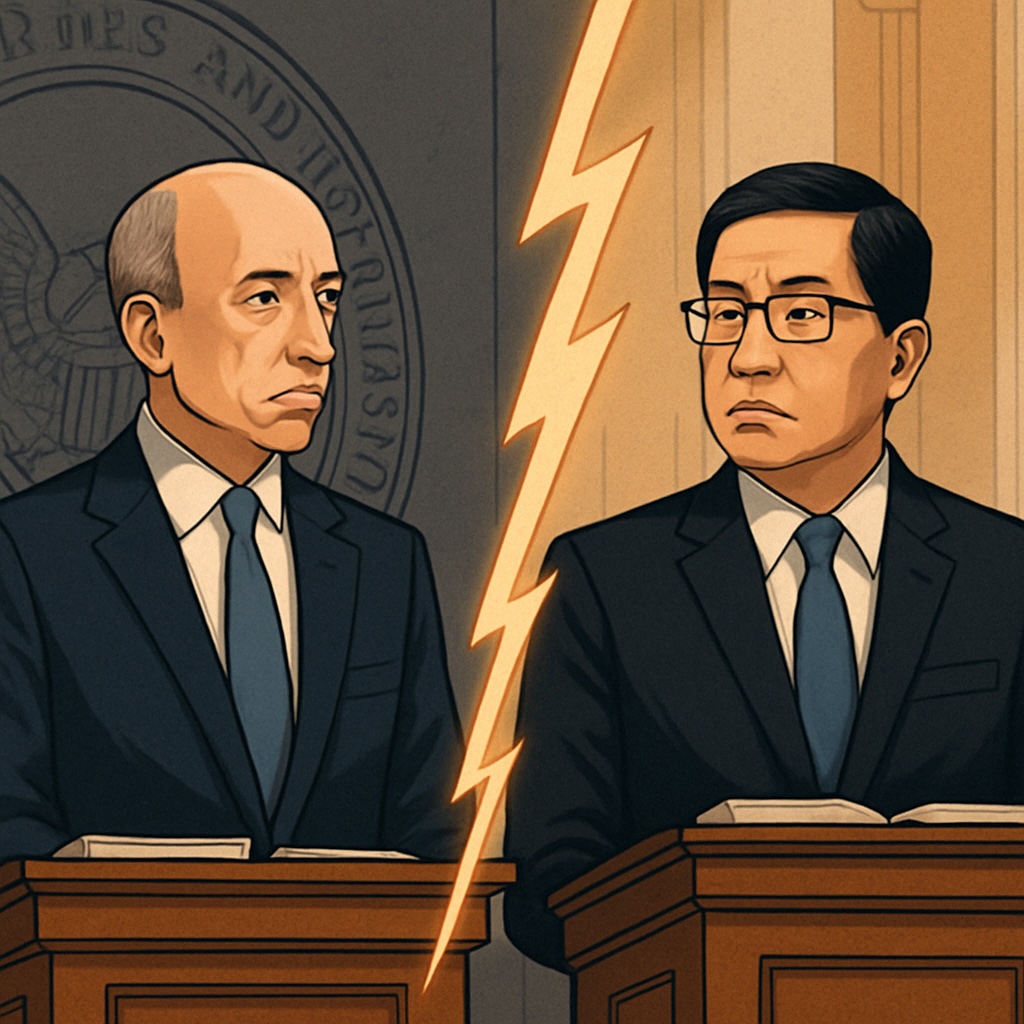

In what might be the most bureaucratically spicy footnote of 2025, SEC Chair Gary Gensler and Commissioner Mark Uyeda are sparring in public—again. The topic, unsurprisingly, is digital assets. And the venue? Not a hearing, not a panel, but a series of dueling statements embedded within an SEC rulemaking release.

Yes, the crypto community asked for clarity. What it got instead was passive-aggressive footnotes from one commissioner and a sharply worded rebuke from another. Gensler used a recent comment period to reiterate his long-standing stance that crypto markets do not need bespoke rules. As he put it, those advocating for a separate regime just want to “avoid complying with the securities laws.” Enter Uyeda, who fired back with a scathing counterpoint: that Gensler’s framing is “an unprovoked attack” and part of a pattern that discourages meaningful engagement—both within the agency and with the public.

If the SEC is supposed to be the adult in the room, it just threw a very policy-laden tantrum.

The SEC’s Ongoing Identity Crisis Around Crypto

This episode is more than a personality clash. It reflects the SEC’s broader existential crisis about how to regulate digital assets. Since the SEC began ramping up crypto enforcement in 2021, it has maintained that most tokens are securities, and thus subject to U.S. securities law. The problem? There’s still no clear registration framework that accounts for the decentralized, programmable, and composable nature of digital assets.

Enforcement actions have followed this logic: lawsuits against Coinbase for operating as an unregistered exchange; actions against Kraken for its staking services; and of course, the SEC’s years-long battle with Ripple Labs. In each case, the agency asserts its jurisdiction over digital assets using a legal test first articulated in 1946: the Howey Test.

Meanwhile, the industry keeps asking for a bespoke framework, similar to what’s unfolding in other jurisdictions around the world. But in the U.S., that conversation keeps being redirected to… well, footnotes.

Why Uyeda’s Pushback Matters

Commissioner Uyeda’s criticism isn’t just procedural—it’s institutional. When he calls Gensler’s comments “unprovoked,” he’s also signaling something deeper: that unilateralism is overtaking collaboration within the SEC. And when the SEC appears fractured, it undermines public trust—not just in crypto regulation, but in the agency’s broader capacity to manage emerging markets.

Uyeda isn’t alone in sounding the alarm. Commissioner Hester Peirce has repeatedly published dissents calling out the Commission’s lack of regulatory clarity. She’s warned that enforcement-first approaches stifle innovation and drive projects offshore—a concern echoed by developers, founders, and policymakers across the space.

And the data backs it up. The U.S. continues to lose blockchain developer share to countries that offer more consistent or proactive regulatory paths. That’s not just a policy failure—it’s a strategic one.

What This Means for the Crypto Industry

Here’s the practical fallout: crypto founders and funds are stuck in a state of regulated limbo. They know they must “comply,” but they’re unsure which rules apply. Registering as a broker-dealer, ATS, or investment adviser may not even be possible for many token projects, especially those operating in decentralized environments. There’s no workable disclosure regime. No sandbox. No crypto-native exemptions. Just enforcement actions, investigative subpoenas, and press releases.

This uncertainty creates a chilling effect. Some builders shut down U.S. operations altogether. Others continue innovating abroad. The net result? The U.S. risks becoming a hostile jurisdiction for blockchain development, not because of legislation, but because of inconsistent messaging and footnote feuds.

Meanwhile, the Rest of the World Is Moving On

While Gensler and Uyeda debate in public, other governments are getting organized. The EU, Singapore, Switzerland, the UK, and even Dubai have all introduced frameworks that—while imperfect—at least offer a starting point. They are attracting projects, talent, and capital, while the U.S. stays caught in a cycle of turf wars and regulatory ambiguity.

It’s increasingly awkward to see a country that prides itself on leading innovation fall behind not because it lacks talent, but because it refuses to modernize the rules of engagement.

The Bottom Line: Crypto Needs Regulation, Not Rhetoric

Let’s be clear—reasonable people can disagree about how to regulate crypto. Should tokens be treated as securities? Should we define new asset classes? Should DAOs be recognized under U.S. law? These are hard, meaningful questions. But they deserve more than veiled jabs buried in footnotes. They require transparency, dialogue, and leadership.

Until then, the industry remains stuck between two extremes: on one hand, Gensler’s firm belief that “everything’s already covered,” and on the other, commissioners like Uyeda arguing that maybe we need to build something new. In between lies an industry desperate for clarity—and regulators more interested in one-upping each other than in providing it.

👉 Contact our team if you’re seeking support on compliance, token strategy, or navigating regulatory uncertainty in the U.S