With the post-pandemic pivot toward American entrepreneurship, small businesses and startups are booming; but how are they funded? SAFE notes and Convertible notes are two ways to raise capital by trading future equity for immediate cash.

Through the rise in popularity of platforms like Youtube, Etsy, and Tiktok, millions of people are ditching the idea of the 9-5 and finding ways to turn their passions into careers. The “American entrepreneurship boom” 1 of the post-covid 2020s was evidenced in the U.S. Census Bureau’s 2022 report that 5.1 million new business applications were filed by Americans that year, 1.7 million of which were businesses likely to hire employees.

Daniel Newman and Kenan Fikri of the Economic Innovation Group believe that “the steadiness in application levels exhibited over the course of 2022 offers optimism that the pandemic may have delivered a lasting, positive shock to American entrepreneurship.” 2

This entrepreneurial boom represents more than simple hobbies and self-employment. As the U.S. leads in the number of startups, venture capital funding reached a decade-high of $200 billion in 2022. 3

One of the keys to any successful startup is to secure appropriate funding and understand how that funding will impact your future equity. In this article, we’ll cover an in-depth breakdown of two popular capital-raising options for startups to ensure current and aspiring entrepreneurs are informed about their options.

What is a Convertible Note?

A convertible note is a short-term debt loan provided to companies not ready for valuation. In exchange, investors can convert that debt into company shares once a predetermined milestone is met. 4

Convertible notes allow startup companies to raise money before they offer equity and postpone their valuation while growing their business.

Terms to Know in Convertible Notes

- Discounts: Discounts reward investors for funding the development of the company. Often, a SAFE note will apply discounts on the future converted equity in the range of 10%-30%.

- Valuation Cap: This sets a maximum value at which an investment can be converted into equity, protecting investors from overpaying for equity if the startup’s value skyrockets.

- Interest rate: Convertible notes are debt instruments, essentially loans, that accrue interest. However, in convertible notes, the interest is usually paid in equity rather than cash.

- Maturity date: The date by which the debt must be repaid.

How Do Convertible Notes Work?

The critical element of a convertible note is whether or not the company reaches the conversion event. Unlike SAFEs, convertible notes can have specific parameters around an event that stipulates whether or not the conversion will be triggered. 5

For example, in a SAFE note, the conversion trigger may be a priced equity round, while a convertible note may specify an amount needed to be raised in the round for it to trigger the conversion.

If the company doesn’t experience the conversion event by the maturity date, it functions as a traditional debt instrument and is subject to repayment.

What is a SAFE Note?

In 2013, Y Combinator announced the concept of the SAFE note, describing it as an alternative to convertible notes minimizing some of the disadvantages found in convertible debt.

SAFE is an acronym for Simple Agreement for Future Equity, which in itself is a simple explanation of its function.

SAFEs are a legally binding promise that, in exchange for startup funding, an investor may purchase a certain number of shares for an agreed-upon price sometime in the future when a predetermined event “triggers” the conversion. 6

A safe note, like convertible notes, allows startup companies to raise pre-valuation capital, but unlike convertible notes, it is not a debt instrument and does not accrue interest.

SAFE Note Key Terms

Both SAFEs and convertible notes often include discounts and valuation caps; however, since SAFEs are not debt instruments, there is no maturity date or interest rate. SAFEs include the following elements determining when and how they will convert to company shares. 7

- Conversion Trigger: This predetermined event will trigger the investment-to-equity conversion. Examples of conversion triggers are future financing rounds, mergers, or a company buy-out. The trigger and timeline of conversion should be discussed and agreed upon by both parties to protect future capital and returns.

- Most Favored Nation Provision: A most favored nation clause requires the original SAFE holder to be notified about the subsequent SAFEs and terms if a company acquires SAFE notes from multiple investors. If the terms of the second SAFE are more attractive to the original SAFE holder, they may request the same terms.

- Pro-Rata Rights: These allow investors to invest more money and maintain their percentage of ownership during future equity financing.

How Do SAFE Notes Work?

In both SAFE and convertible notes, early-stage startups are able to raise outside financing prior to any valuation of the company. Here is a basic breakdown of how a SAFE note works:

- An investor provides capital in exchange for the promised future equity.

- The company utilizes the initial investment to grow and develop the business.

- Following significant growth in the company, they gain more investors and receive a post-money valuation.

- A new price per share is calculated based on the company’s post-money valuation.

- The SAFE note is converted into the appropriate number of shares based on the new price per share and any discounts or valuation cap and then distributed to the SAFE investor.

With SAFEs, unlike convertible notes, the investor’s return depends solely on the startup’s success and conversion elements; there’s no equity until the conversion occurs, and there’s no maturity date to take precedent. 8

Types of SAFE Notes 9

-

- Valuation cap, no discount

- Discount, no valuation cap

- Valuation Cap and discount

- Most Favored Nation Clause, no valuation cap, no discount

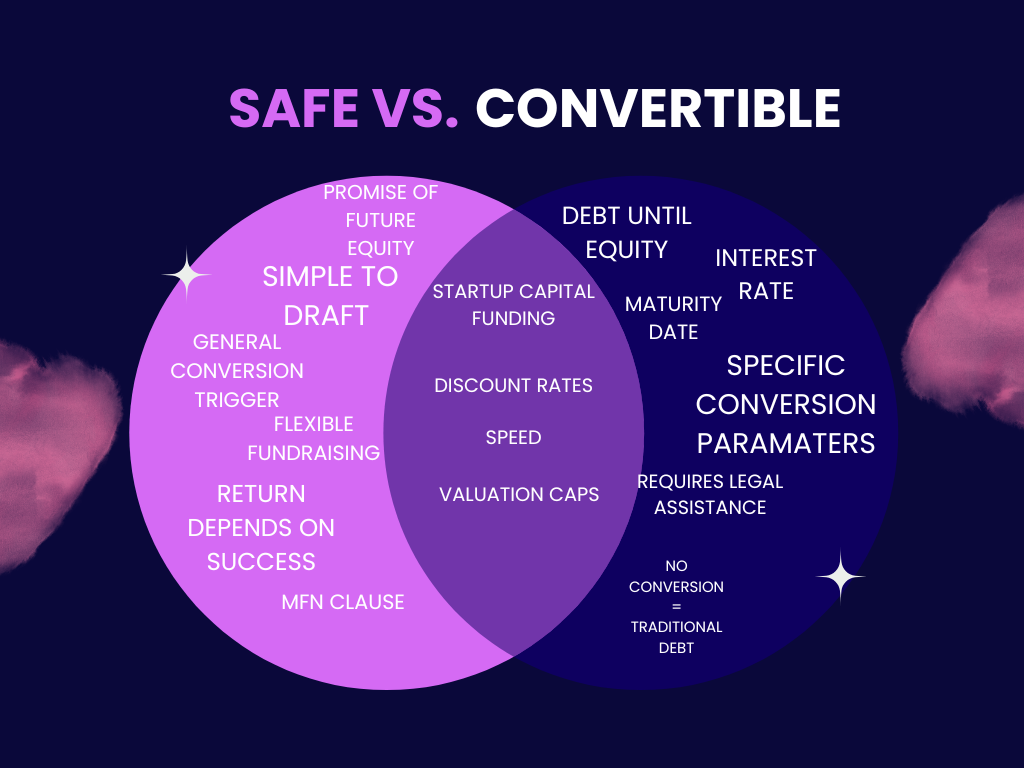

Differences between SAFEs and Convertible Notes

Advantages and Disadvantages

SAFEs

Advantages of SAFEs

- Pre-valuation fundraising

- No loss in equity during the early stages

- No interest

- No repayment if the company fails

- Simple to understand

- Simple to set up and reduces legal fees.

- Straightforward conversion trigger

- Discounted equity rewards for investors

Disadvantages of SAFEs

- Risky to investors, as their returns depend on the company’s success

- No continuous revenue

- No dividends

- The company must be incorporated

Convertible Notes

Advantages of convertible notes

- Pre-valuation fundraising

- No loss in equity during the early stages

- Safer for investors as a debt instrument

- Flexible conversion terms

- Discounted equity rewards for investors

Disadvantages of convertible notes

- Efficient and low risk

- Complex conversion requirements

- Require legal assistance

- Difficult for investors to calculate ROA

- Investors may lose their initial investment upon the dissolution of the company if there’s not enough money left to repay the debt

Which is Better for Companies vs. Investors?

Understanding the similarities and differences between a SAFE and a convertible note is essential for entrepreneurs and founders seeking to raise capital for their startup, as it plays a role in the dilution, control, and ultimate success of fundraising. 10

Founders typically favor SAFE notes due to their simple nature, less stipulation, reduced legal costs, and the absence of debt at the beginning stages of launching their company. 11 They are recommended as the right choice for startups.

On the other hand, convertible notes are typically more investor-friendly because they have guaranteed return or repayment, as well as accrued interest.

Ultimately, which one you decide to use should depend on what reflects the best success rate for your company and the mutual agreement and favor from the founders and investors involved with your startup.

Do Your Research, Know Your Options, and Take the Leap

Launching your startup is a big decision; be sure to research all the fundraising options available to you and seek advice from an expert to ensure you are making the best decision to reach success.

If you dream of starting a company, don’t let a lack of cash scare you. Explore your funding options, understand them, and join the pivot to entrepreneurship. After all, 69% of startup companies were created in the home. 12

1 Jacob Zinkula, The pandemic created an American entrepreneurship boom — and it looks like it’s here to stay, Insider (Jan. 8, 2023, 8:30 AM), https://www.businessinsider.com/entrepreneurship-characteristics-trends-how-start-new-business-america-changed-forever-2023-1.

2 Daniel Newman and Kenan Fikri, Startup Surge Stood Firm Against Economic Headwinds in 2022, Economic Innovation Group (Jan. 24, 2023), https://eig.org/2022-business-formation/?mod=djemRTE_h.

3 Embroker Team, 106 Must-Know Startup Statistics for 2023, Embroker: Blog Business Advice & Research (May 3, 2023), https://www.embroker.com/blog/startup-statistics/.

4 Ian Lee, et al., What is a Convertible Note?, AngelList (last accessed May 23, 2023), https://learn.angellist.com/articles/convertible-note#toc_0_H2.

5 Id.

6 SAFE Note – Definition, Pros and Cons, SAFE vs Convertible Note, Buildd (last accessed May 25, 2023), https://buildd.co/funding/safe-note.

7 Abi Tyas Tunggal, What is a SAFE?, Venture Capital Careers (Feb. 13, 2023), https://venturecapitalcareers.com/blog/safe.

8 SAFE Note, Contracts Counsel (last accessed May 23, 2023), https://www.contractscounsel.com/t/us/safe-note.

9 Hannah Stechenko, What is a safe note? Here is everything you need to know, PandaDoc Blog (Feb. 16, 2022), https://www.pandadoc.com/blog/what-is-a-safe-note/.

10 Tiho Bajic, Founder equity guide for convertible notes and SAFEs usage, LTSE Equity (last accessed May 23, 2023), https://equity.ltse.com/resources/guide-to-founder-equity-while-using-convertible-notes-and-safes.

11 SAFE Note V. Convertible Note: What’s Better? JonathanHung.com (last accessed May 29, 2023), https://jonathanhung.com/safe-note-v-convertible-note-whats-better/#:~:text=SAFE notes are very similar,convertible notes remain the same.

12 Sandeep Babu, STARTUP STATISTICS 2023 – The Numbers You Need to Know, Small Business Trends (updated Mar 28, 2023), https://smallbiztrends.com/2022/12/startup-statistics.html.