Short Answer:

Fully diluted shares represent the total number of shares of a company if all convertible securities, like stock options and convertible bonds, were exercised, potentially diluting existing ownership percentages.

Introduction

Navigating the world of finance and investment brings its unique thrills, much like the exhilarating experience of being a shareholder and owning a slice of a company’s pie. This exhilaration is akin to the ventures and complexities I’ve encountered in my legal career, particularly in dealing with venture capital, M&A, and private equity transactions. Just as I’ve navigated the intricate legal landscapes at prestigious AM Law 200 firm Locke Lord LLP, the concept of fully diluted shares presents an intriguing financial landscape that demands a keen understanding of its impact on ownership stakes and a company’s earnings per share (EPS).

Fully diluted shares, a term that might seem esoteric at first glance, play a pivotal role in determining the true value of an investor’s stake in a company. This concept becomes particularly crucial when a company decides to expand its share base, reminiscent of the detailed and careful scrutiny required in major real estate & venture transactions I’ve handled during my tenure at Lowndes, Drosdick, Doster, Kantor & Reed, P.A. Just as in legal negotiations where every clause and provision could significantly impact the outcome, the calculation of fully diluted shares involves a comprehensive consideration of all convertible securities that could potentially dilute an investor’s share in the future.

In this exploration, we delve into the world of fully diluted shares, drawing parallels between the strategic considerations in legal practice and the financial strategies companies and investors employ to safeguard their interests. Whether mitigating the effects of dilution on ownership stake and voting influence or employing anti-dilution clauses, the principles of vigilance, foresight, and strategic planning are paramount. Let’s embark on this journey to uncover the depths of fully diluted shares and their profound impact on the financial health of companies and the stakes of investors.

Key Takeaways

- Fully diluted shares refer to the total number of common shares a company would have if all convertible securities were exercised, and are important for investors as they provide a more accurate representation of financial health.

- Basic shares represent existing outstanding stock, whereas fully diluted ones incorporate potential sources of dilution in EPS calculations.

- Companies & investors can employ strategies such as controlling share numbers or incorporating anti-dilution clauses to mitigate effects on ownership stake & voting influence.

What are Fully Diluted Shares?

In the corporate world, the term “fully diluted shares” refers to the total number of common shares of a company that would be outstanding if all convertible securities were exercised. Think of it as the total number of slices that the company’s pie could potentially be divided into. These convertible securities can include employee stock options, convertible bonds, and convertible preferred stock. When exercised, they increase the total number of shares available to trade on the open market.

This concept is particularly significant when calculating a company’s EPS, which is a key measure of a company’s earnings. The EPS reflects how many dollars are earned for each share of common stock. Fully diluted shares can reduce the EPS, offering a more precise gauge of a company’s financial performance from the shareholders’ viewpoint.

Convertible Securities and Employee Stock Options

The calculation of fully diluted shares heavily relies on convertible securities and employee stock options. Convertible securities, such as convertible bonds and convertible preferred stock, can be converted into common shares, thereby increasing the overall number of outstanding shares. This conversion can impact the company’s EPS by reducing the earnings attributed to each common stock share.

Companies often use stock-based compensation as a method to incentivize and reward their employees. This involves allocating company stock to employees, which results in an increase in the total number of shares outstanding and leads to share dilution. The dilution can also be caused by convertible bonds outstanding, which can be converted into common shares.

Importance for Investors

You may question the relevance of fully diluted shares as an investor. Well, they can provide you with a more accurate representation of a company’s financial health and potential future earnings. This is because fully diluted shares account for all potential sources of dilution, such as stock options, warrants, and convertible securities. This comprehensive view of potential future earnings can influence your sentiment, market perceptions, and the stock price.

Moreover, it’s vital to consider potential dilution, as it could notably affect your ownership stake and voting influence in a company. The issuance of new shares or raising of capital can dilute the stakes of existing shareholders, thereby affecting the value of your investments and your ability to influence company decisions.

Comparing Basic Shares and Fully Diluted Shares

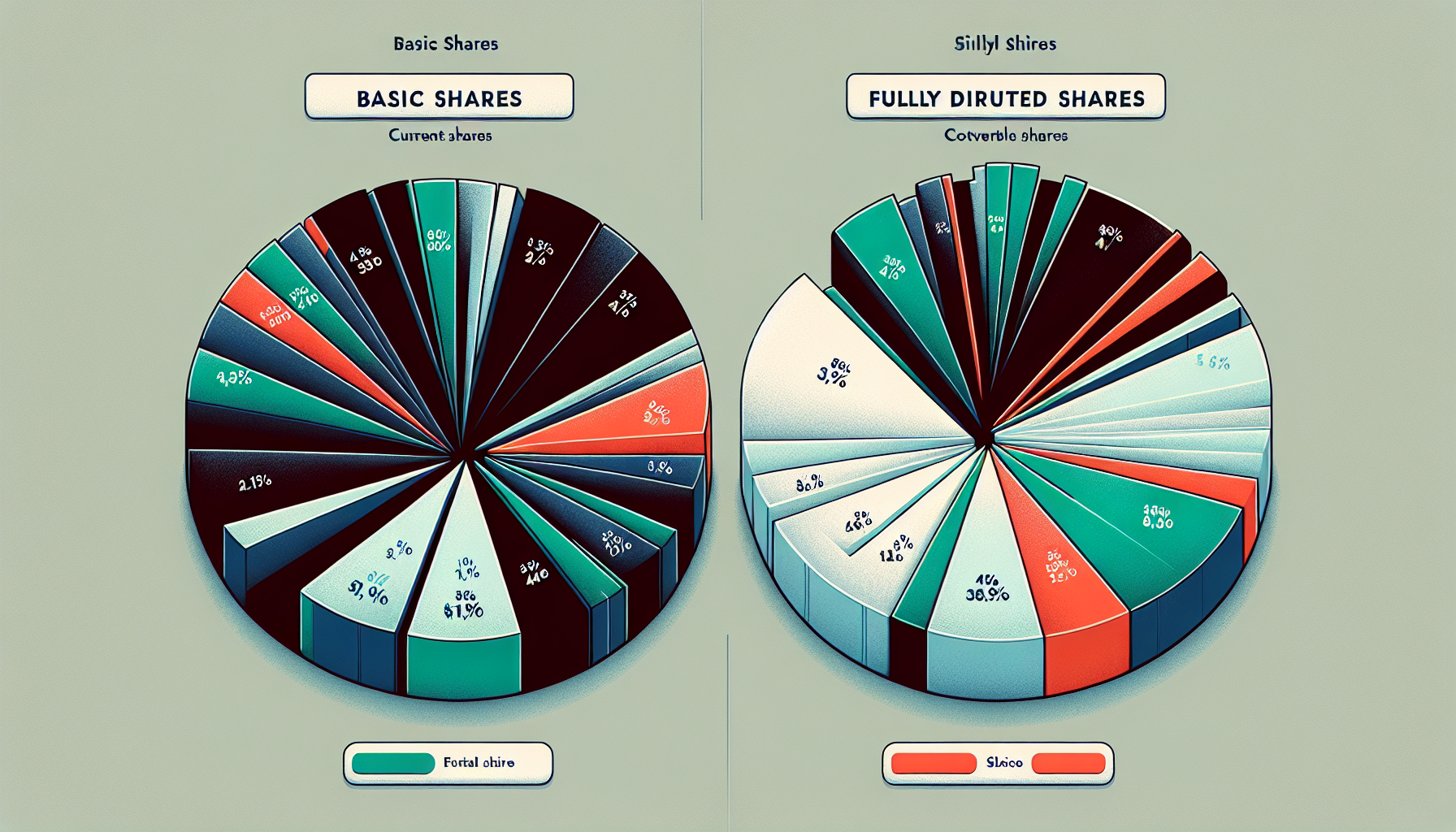

Having understood what fully diluted shares are, it’s now time to compare them with basic shares. Basic shares denote the existing number of outstanding shares, whereas fully diluted shares encompass all potential sources of dilution from convertible securities.

This difference comes into play when calculating EPS. To calculate the basic EPS, the total net income for the period is divided by the weighted average shares outstanding. This provides a measure of the earnings allocated to each share. On the other hand, diluted EPS accounts for the potential increase in shares from items such as stock options and convertible securities, offering a measure that reflects these potential changes to the share count.

Basic Shares

Basic shares in the stock market are the total number of shares issued by a company to investors. These shares signify ownership in the company and are tradable. The method for calculating basic shares involves dividing a company’s net income by the weighted average of common shares outstanding. The publicly traded share price is influenced by factors such as the company’s performance and market conditions.

When calculating basic earnings per share (EPS), the primary factors taken into consideration are the net income (after deducting preferred dividends) and the weighted average number of common shares outstanding during the period. The basic EPS is the earnings per share that is not adjusted for dilution, so it does not take into account any potential increase in shares from convertible securities or stock options.

Fully Diluted Shares

On the flip side, fully diluted shares take into account all potential sources of dilution. Fully diluted EPS refers to the earnings per share that considers potential sources of dilution, such as stock options and convertible securities. This calculation offers a more precise representation of a company’s earnings potential by considering the potential impact of these dilutive securities on profitability.

To calculate fully diluted EPS, the net income during the period is divided by the average fully diluted shares outstanding in the period, taking into account the beginning period balance. This includes potential additional shares from in-the-money dilutive securities, common shares, special securities, and stock options.

In the context of financial reporting, fully diluted shares are accounted for by incorporating all potential dilution arising from securities such as:

- convertibles

- options

- warrants

- RSUs

This effectively augments the number of shares outstanding.

Step-by-Step Guide to Calculating Fully Diluted Shares

With the basics covered, we can now proceed to the steps involved in calculating fully diluted shares. This involves considering all potential sources of dilution, including:

- Stock options

- Warrants

- Convertible bonds

- Preferred stock

The process starts by identifying the number of new shares that would be generated from employee stock options and restricted stock units (RSUs), using a method known as the treasury stock method. Warrants are then taken into consideration by incorporating the potential additional shares generated from in-the-money dilution to the basic shares outstanding.

Considering Stock Options

The calculation of fully diluted shares from stock options involves the following steps:

- Identify the basic share count of the company.

- Add the number of stock options to the basic share count.

- Determine the quantity of stock options awarded, using valuation formulas such as Black-Scholes.

- Exclude any invalid stock options.

- Sum up the resulting numbers to obtain the fully diluted share count.

However, keep in mind that not all stock options may actually get converted into shares. The duration of the vesting period for employee stock options usually ranges between two and five years. Companies make estimates for forfeitures and the total number of shares that will ultimately vest based on their judgment.

Incorporating Warrants

Moving forward, the calculation should include warrants. Warrants are somewhat similar to stock options, but they are sold for cash instead of being granted to employees. Each warrant gives the holder the right to purchase a predetermined number of shares at a specified price. When warrants are exercised, the company issues additional shares and sells them to the warrant holder at the strike price, increasing the total number of shares outstanding.

The impact of the conversion price of warrants on the number of fully diluted shares is significant. New shares are issued at the conversion price, which is typically below the market price, resulting in dilution of the existing shareholders’ interests. The number of shares that can potentially be added to the total number of outstanding shares is determined by multiplying the number of unexpired convertible bonds by the conversion ratio.

Factoring in Convertible Bonds and Preferred Stock

As we proceed further, convertible bonds and convertible preferred stock outstanding must also be considered. These are securities that can be converted into common shares, thereby increasing the number of outstanding shares. The number of shares that would be issued if the convertible bonds and preferred stock were converted into common stock at the predetermined conversion price is added to the current number of outstanding shares. The total represents the fully diluted shares, which includes the potential shares from the conversion of convertible bonds and preferred stock.

Similarly, if the preferred stock is convertible, it is included in the calculation as if it has been converted into common shares. Consequently, the number of fully diluted shares will encompass both the common shares and the potential additional shares resulting from the conversion of preferred stock.

Calculating the Total Fully Diluted Share Count

To calculate the total fully diluted share count, simply sum up all the additional shares from potential dilution to the current outstanding shares. This includes shares from:

- stock options

- warrants

- convertible bonds

- preferred stock

The number obtained represents the total number of fully diluted shares available. This is an important measure for understanding the company’s capital structure.

While this process may seem straightforward, it does require substantial estimation and judgment, especially when considering the potential conversion of stock options and convertible securities. Therefore, it’s crucial to approach this process with care and a thorough understanding of the underlying principles.

Pros and Cons of Fully Diluted Shares

As with most financial concepts, fully diluted shares have distinct advantages and disadvantages for both companies and preferred shareholders, including the potential for fewer earnings.

For companies, fully diluted shares:

- Assist in determining the price per share during funding periods

- Provide a more precise depiction of a company’s EPS

- Support capital infusion, accurate valuation, and enhanced investor confidence.

However, for investors, fully diluted shares may present certain disadvantages, including:

- Potential reduction in their ownership percentage

- Potential transfer of ownership from insiders to external shareholders

- Significant impact on the company’s EPS

- In cases of excessive dilution, the original founders may even risk losing control of the company.

Benefits for Companies

Looking more closely at the benefits for companies. Fully diluted shares can enable companies to raise capital by offering additional shares to investors. This enhances the company’s financial resources, facilitating expansion, innovation, or debt repayment. Companies such as Uber and Airbnb have employed this approach to finance their growth.

Another advantage is the use of fully diluted shares as equity-based compensation for employees. This provides employees with a sense of ownership, aligning their interests with the success of the company. It offers long-term incentives, potentially significant financial rewards, and enhances the retention and attraction of talent.

Drawbacks for Investors

For an investor, the impact of fully diluted shares may result in a decrease in their ownership stake. As a result, your slice of the company’s pie could become smaller, reducing your relative voting power and affecting your ability to influence company decisions.

Moreover, fully diluted shares can decrease the share value for investors due to the higher share count resulting in lower EPS. This may lead to negative investor sentiment, altered market perceptions, and ultimately a decrease in stock price. Therefore, as an investor, it’s crucial to be mindful of potential dilution and make informed investment decisions.

Real-Life Examples of Fully Diluted Shares

In order to provide a better understanding, let’s explore some real-life examples. Startups commonly utilize fully diluted shares to calculate the ownership stakes of investors, employees, and founders, taking into account stock options, warrants, and convertible securities. Additionally, publicly traded companies may employ fully diluted shares to calculate EPS and evaluate the impact of equity-based compensation on potential dilution.

Specific case studies, such as mergers and acquisitions, illustrate how share dilution can lead to a reduction in ownership percentages for individual shareholders, even if the merged company’s value increases. Furthermore, in the context of employee share schemes, the company’s valuation may rise, but this could be accompanied by a decrease in the ownership percentages of employee shareholders.

Strategies for Managing Share Dilution

Thus, the question arises: can share dilution be managed? Yes, there are several strategies that companies and investors can employ to mitigate the impact of dilution. Some of these strategies include:

- Controlling the number of fully diluted shares

- Engaging in share repurchases

- Incorporating anti-dilution clauses

- Making strategic financing decisions

- Emphasizing communication and transparency

By implementing these strategies, companies can effectively manage the impact of fully diluted shares on financial performance.

On the other hand, investors can also adopt strategies to manage share dilution. This includes:

- Negotiating vesting schedules with new investors

- Limiting pro-rata rights to lead investors

- Being deliberate and intentional about the investors brought on board

- Being strategic about equity dilution to avoid giving away large portions of ownership.

Summary

To sum up, fully diluted shares are an important concept that can significantly impact a company’s financial performance and an investor’s ownership stake. While they provide a more accurate representation of a company’s earnings potential by considering all sources of dilution, they also present certain drawbacks, such as potential reduction in investors’ ownership percentage and EPS. Therefore, it’s crucial for both companies and investors to understand the concept of fully diluted shares and make informed decisions about equity-based compensation plans and convertible securities.

Resources

For those seeking to deepen their understanding of fully diluted shares and their impact on investors and companies alike, the following resources offer valuable insights and comprehensive analyses:

- Investopedia: Provides a wealth of knowledge on investment terms, including an in-depth article on fully diluted shares. This resource is ideal for beginners and seasoned investors looking to refresh their knowledge. Visit Investopedia

- SEC (U.S. Securities and Exchange Commission): Offers official documents and filings that can give you real examples of how fully diluted shares are reported by publicly traded companies. Explore the SEC

- Morningstar: Known for its investment research, Morningstar offers analyses and ratings that can help you understand the financial health of companies, taking into account the effect of fully diluted shares. Check out Morningstar

- Harvard Law School Forum on Corporate Governance: Provides articles and discussions on corporate governance, including topics like share dilution and shareholder rights. Visit Harvard Law School Forum

- Financial Times: Offers news and analysis on global financial markets, including impacts of share dilution on company valuations and market perceptions. Read Financial Times

Frequently Asked Questions

What does total fully diluted shares mean?

Fully diluted shares refer to the total number of common shares of a company that are available for trading on the open market, including all converted bonds and exercised stock options.

Are fully diluted shares good or bad?

Overall, fully diluted shares can be good or bad depending on the context. If it is done to raise additional capital which leads to greater returns down the line, then it may be beneficial. However, if it results in a decrease of share value and ownership percentage, it could lead to a decline in investor confidence and stock prices.

What is the difference between fully diluted and authorized shares?

Fully diluted shares include all issued and outstanding shares, as well as those that would be issued if all options and warrants are exercised. On the other hand, authorized shares refer only to the stock that has been approved for issue by the company’s board of directors.

What is an example of a fully diluted share?

An example of a fully diluted share is when a firm has convertible bonds and preferred stock outstanding, both of which can be converted into common stock. This results in a total of 200,000 shares of common stock being available.

How do fully diluted shares impact EPS?

Fully diluted shares can have a negative impact on EPS, as they provide a more accurate representation of a company’s financial performance from the shareholders’ perspective.