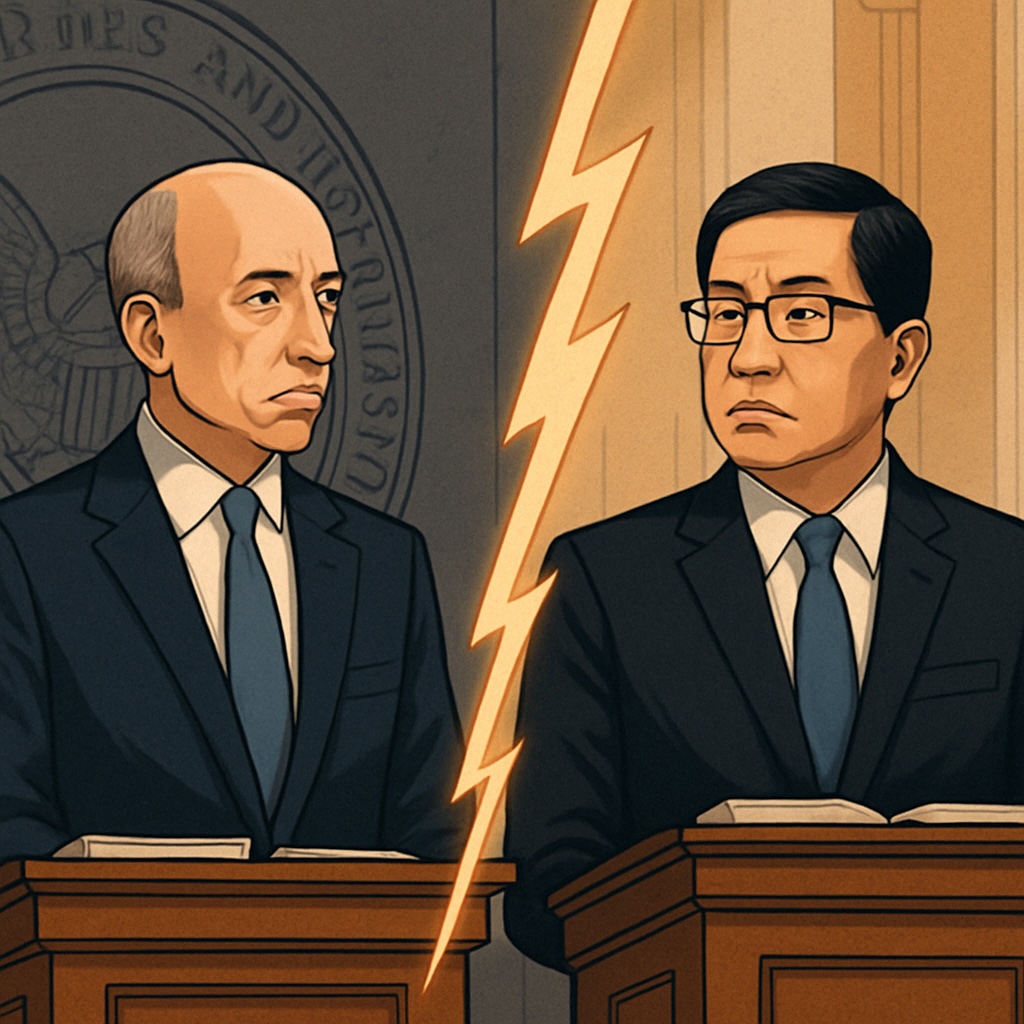

SEC Commissioners Are Subtweeting Each Other—and Crypto’s Caught in the Crossfire

A quiet footnote from SEC Chair Gary Gensler just sparked a not-so-quiet rebuke from Commissioner Mark Uyeda—exposing deep rifts inside the agency over how to regulate crypto. With no clear rules and rising public tension, the SEC’s internal divide may be the biggest threat to digital asset clarity yet.