The Digital Asset Market Clarity Act of 2025

The Digital Asset Market Clarity Act of 2025 (H.R. 3633) introduces the first comprehensive U.S. framework for regulating crypto assets, clarifying when a token is a security or a commodity—and which agency has jurisdiction. By defining key blockchain terms, outlining token lifecycle transitions, and establishing dual registration regimes under the SEC and CFTC, the Act offers long-awaited regulatory certainty for startups, exchanges, and investors navigating the evolving digital asset ecosystem.

Unlocking Tax-Free Wealth: A Practical Guide to QSBS for Startup Founders

Unlock the power of QSBS and discover how startup founders can turn equity into a tax-free windfall. This guide breaks down Qualified Small Business Stock (QSBS) eligibility, tax savings of up to $10 million, and critical steps entrepreneurs must take to preserve this valuable exemption. Whether you’re planning your next fundraising round or structuring a cap table, understanding QSBS could mean millions in tax savings.

Profits Interests vs. Capital Units: Why Private-Equity Sponsors Still Need the 83(b) Election

Profits interests ensure tax-efficient carried interest with zero grant-date value, avoiding payroll traps. The 83(b) election locks in $0 valuation, secures capital-gain treatment, and protects early exits under IRS rules (Rev. Proc. 93-27, 2001-43).

Understanding the GENIUS Act

The GENIUS Act could redefine how stablecoins are issued and regulated in the U.S., offering startups a clear path to compliance with built-in protections for consumers. This article breaks down the Act’s core provisions and explains how it lowers barriers for innovators while strengthening trust in the digital dollar ecosystem.

Digital Asset Market Structure Discussion Draft

The discussion draft divides regulatory authority between the CFTC and the SEC, establishing dual registration regimes for intermediaries and trading platforms, carving out exemptions for legitimate DeFi activity, and directing both agencies to coordinate rules and avoid redundant oversight. The bill replaces today’s fragmented enforcement-based model with a proactive legal framework that balances consumer protection with U.S. digital asset competitiveness.

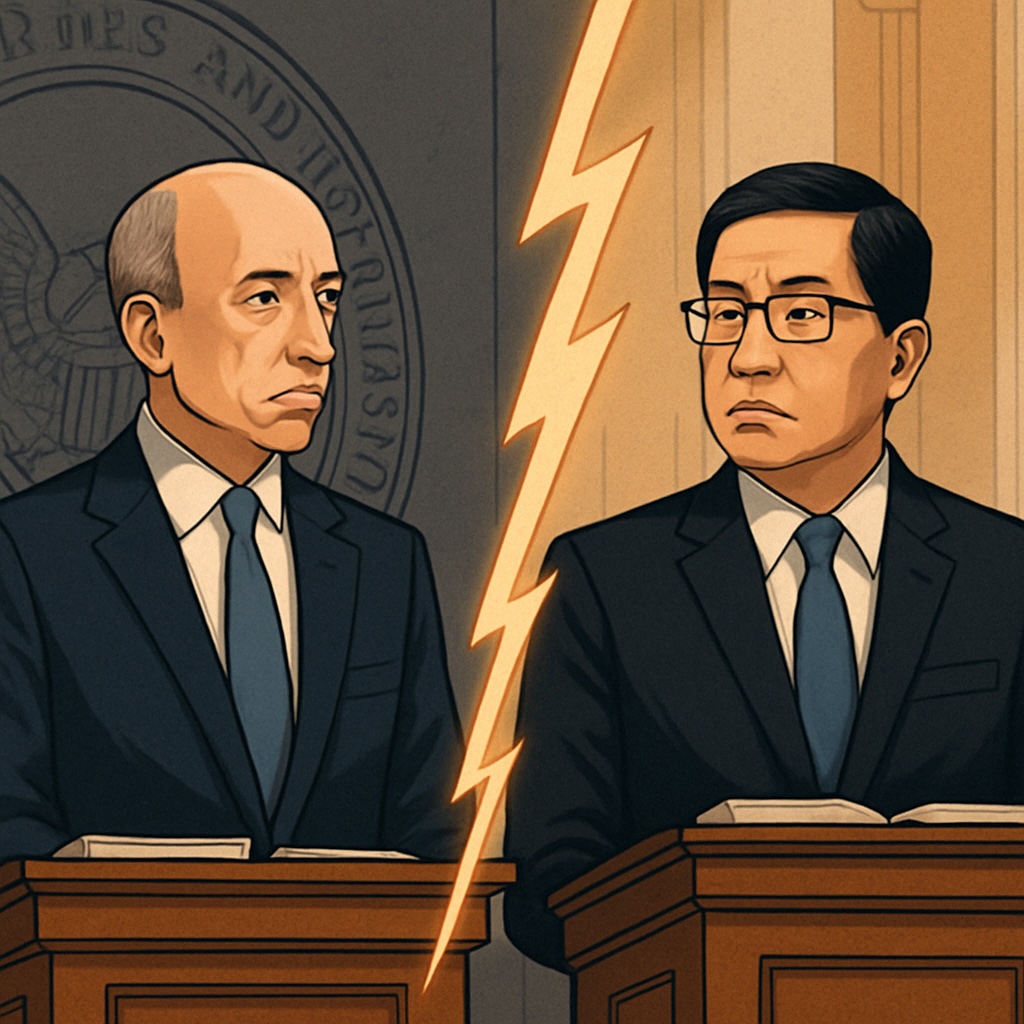

SEC Commissioners Are Subtweeting Each Other—and Crypto’s Caught in the Crossfire

A quiet footnote from SEC Chair Gary Gensler just sparked a not-so-quiet rebuke from Commissioner Mark Uyeda—exposing deep rifts inside the agency over how to regulate crypto. With no clear rules and rising public tension, the SEC’s internal divide may be the biggest threat to digital asset clarity yet.

Give us a call at

904-234-5653

or fill out the form below for a consultation.

"*" indicates required fields