The Rundown:

- In Biden’s Crypto Executive Order, many of the ordered responses had a 180 day deadline that set the due date for the day after Labor Day.

- As the deadline has passed, only the Department of Justice and the Treasury have issued their responses.

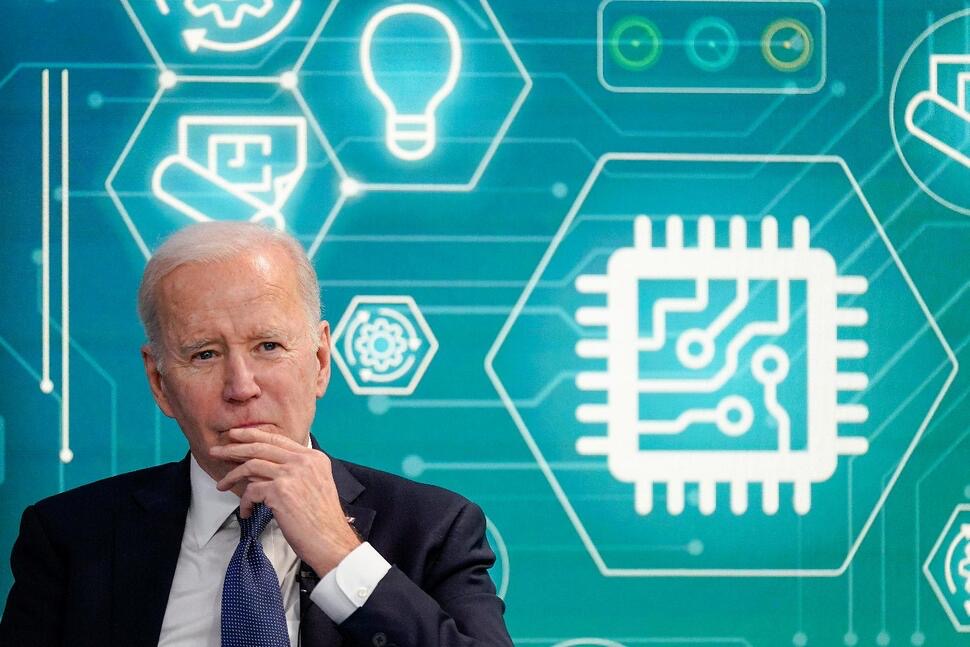

Biden’s Executive Order

In response to the rapid growth of the digital assets industry, Joe Biden’s March 9th Executive Order on Ensuring Responsible Development of Digital Assets called to action a whole-of-government approach to address the accompanying risk and benefits of digital assets and their technological framework.

The Order delegates interagency coordination for research, report and development of six focus areas: consumer and investor protection, financial stability, illicit finance, U.S. leadership in the global financial system and economic competitiveness; financial inclusion, and responsible innovation. Biden mandated responses from various government agencies relative to those priorities. The interagency process includes the Secretary of State, the Secretary of the Treasury, the Secretary of Defense, the Attorney General, and the Director of National Intelligence and several other senior officials and representatives.

Agency Response

Per the Order, the majority of the responses were due 180 days after its release, which fell on Labor Day, making the official due date September 6th.

The agencies listed below were required to issue a response on or before September 6th. Please see below for an description of the relevant agencies and their response status (only two have responded to date):

- The Justice Department, in accordance with the Departments of Treasury and Homeland Security: a report on strengthening international law enforcement cooperation for “detecting, investigating, and prosecuting criminal activity related to digital assets.”

- Status: Submitted June 6th by the Department of Justice.

- The Justice Department: an assessment on whether or not a Central Bank Digital Currency (”CBDC”) would call for new legislation.

- Status: Not yet submitted.

- The Treasury: A framework for interagency international engagement regarding the adoption of global digital assets principles and standards and to promote their development.

- Status: The Department of Treasury issued a press release on July 7th confirming the delivery of the requested framework.

- The Treasury: A report on the future of money and payment systems and relevant analysis on a potential United States CBDC.

- Status: Not yet submitted.

- The Treasury in accordance with relevant regulatory agencies: A report on the implications of the developments and adoption of digital assets.

- Status: The final report has not been issued, however the department issued a request for public comment on the responsible development and use of digital assets on July 8th. The request stated “In particular, the Department invites input, data, and recommendations pertaining to the implications of development and adoption of digital assets and changes in financial market and payment infrastructures for United States consumers, investors, businesses, and for equitable economic growth.” The last day for comment is marked as September 8th, so it’s possible the report will be issued shortly after.

- The Office of Science and Technology Policy: A technical evaluation on the technological implications of introducing a CBDC as well as the relationship between distributed ledger technology and economic and energy transitions.

- Status: Not yet submitted

- The Department of Commerce: A framework for enhancing United States economic competitiveness in digital asset technologies.

- Status: Not yet submitted.

We would hope to see the remaining outstanding responses very soon and Montague Law is actively watching for updates.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Securities law is complex and highly fact specific to any given circumstance and readers should contact an attorney for advice regarding any type of legal matter.